Your plan from AGEHCUQTR

The Plan

Plan Enrollment Family Coverage International StudentsTravel Assistance FAQ

You are automatically enrolled in a student supplemental group insurance plan through your student association. For less than $22/month, you can benefit from an advantageous coverage, in addition to a host of discounts and preferential rates from our Discount Network discount partners. However, if you do not wish to take advantage of these benefits, you may opt-out of the plan during the coverage amendment and withdrawal period. You may already be covered by another insurance plan, so it is important that you confirm your coverages, compare them, and that you consider the option to combine benefits before your withdrawal. For more information on the coordination of benefits, please refer to the Claims 101 section.

AGEHCUQTR provides you with extended health insurance, dental and eye care, as well as accident and travel insurance.

Plan Enrollment

2024-2025 Plan Enrollment

The insurance premium is included in your tuition invoice. It is billed into two installments: the first in the Fall semester, and the second in the Winter semester. All academic fees for the current semester must be paid before you can receive reimbursement.

| Dental | Health, Accident and Travel | Health, Dental, Accident and Travel | |

|---|---|---|---|

| Fall Sept 1st to Dec 31st |

$59 | $30 | $89 |

| Winter Jan 1st to Aug 31st |

$110 | $60 | $170 |

| Annual Individual Total | $169 | $90 | $259 |

If applicable, fees include premiums, administration fees, commissions, withholdings, and taxes that may apply to the plan.

Family Coverage

During the amendment period, you may extend the plan’s coverage to your dependents (children and/or spouse), providing an affordable family plan.

Amendment Period:

Fall 2022: August 15th to September 30th

Winter 2023 – January 1st to January 31st

To do so, please complete and forward the Family Coverage form for your dependents before the end of the modification period. Our team will then analyze the application received and contact you within 5 business days. Wait for the confirmation of a member of our team to know the amount of the contribution to be paid as well as the payment terms.

| Dental | Health, Accident and Travel | Health, Dental, Accident and Travel | |

|---|---|---|---|

| Adding Dependents(s) (same coverage as the insured) |

N/A | N/A | $259 / person |

International student community

New this year, international students who are members of the student association are automatically enrolled in the dental AND health sections. This means you benefit from the same coverage as all association members.

Don’t want insurance coverage? You can opt out during the opt-out period; go to the Opt-out tab for full details.

During the modification period, you have the option of extending your coverage to your children and/or spouse. Your dependents will benefit from the same coverage as you. To add dependents, you must send the Family Coverage form (form only available during the modification period) to student@majorplan.ca before the end of the modification period. A member of our team will contact you for the payment procedure once the form has been received.

Travel Assistance

Here is the phone number to contact for travel insurance assistance.

Travel Insurance Assistance 1 877.207.5018

FAQ (Coming Soon)

Coverage Offered by

Heath and dental: Humania

Accidents and travel: AIG Insurance Company of Canada

Coverage

2024-2025 Coverage

Coverage Period

The coverage period is divided into two periods: September 1, 2024, to August 31, 2025. In order to be eligible for both, you must maintain your student status and student association membership for both.

Fall: September 1 to December 31

Winter: January 1 to August 31

Health Care

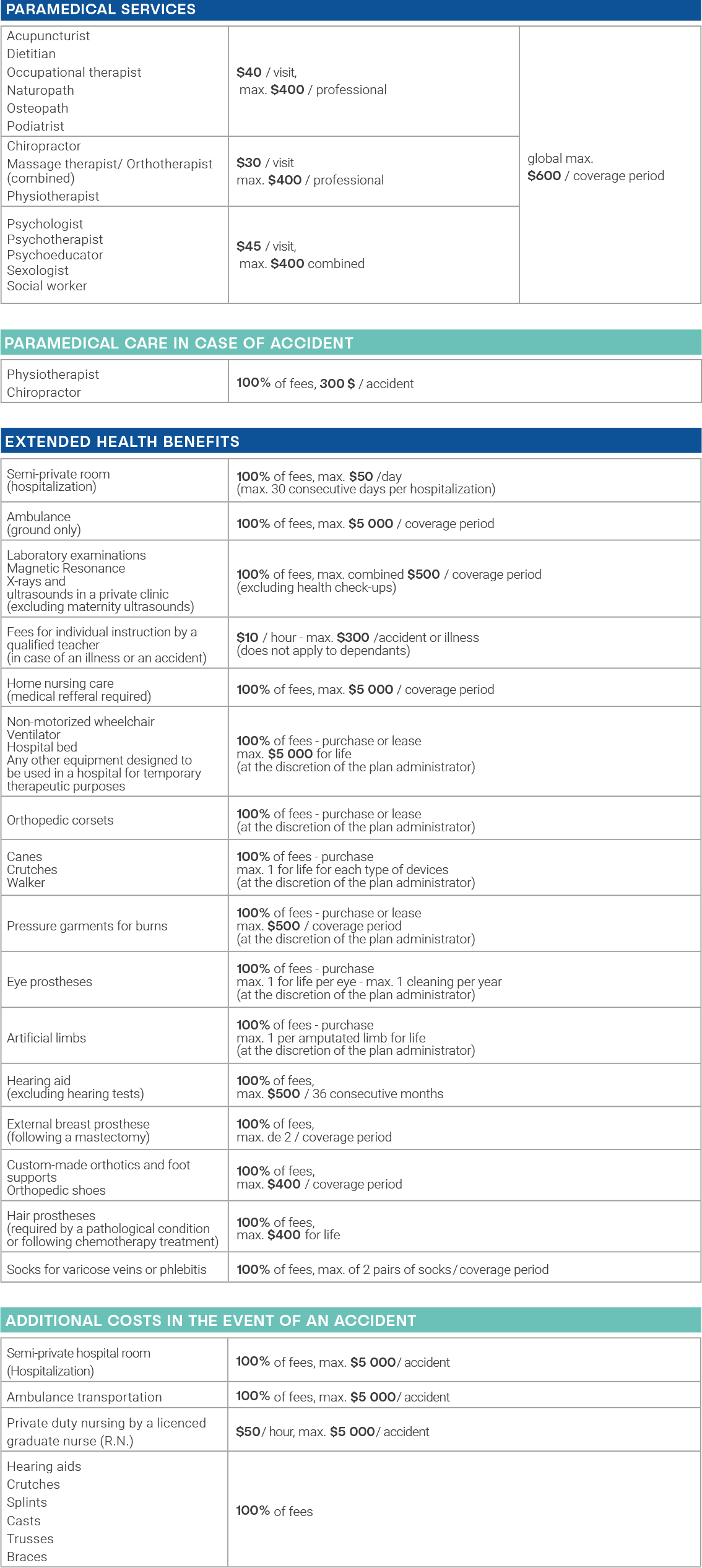

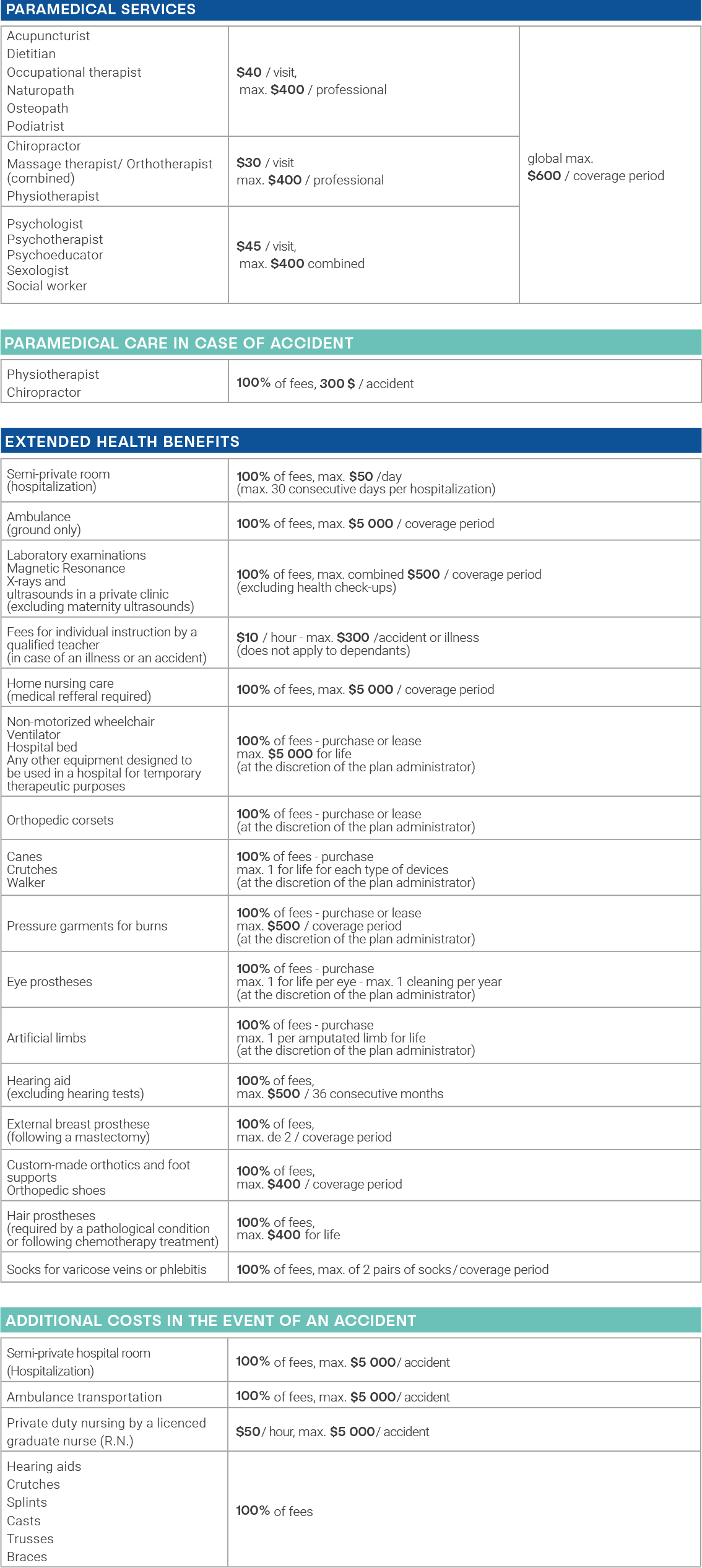

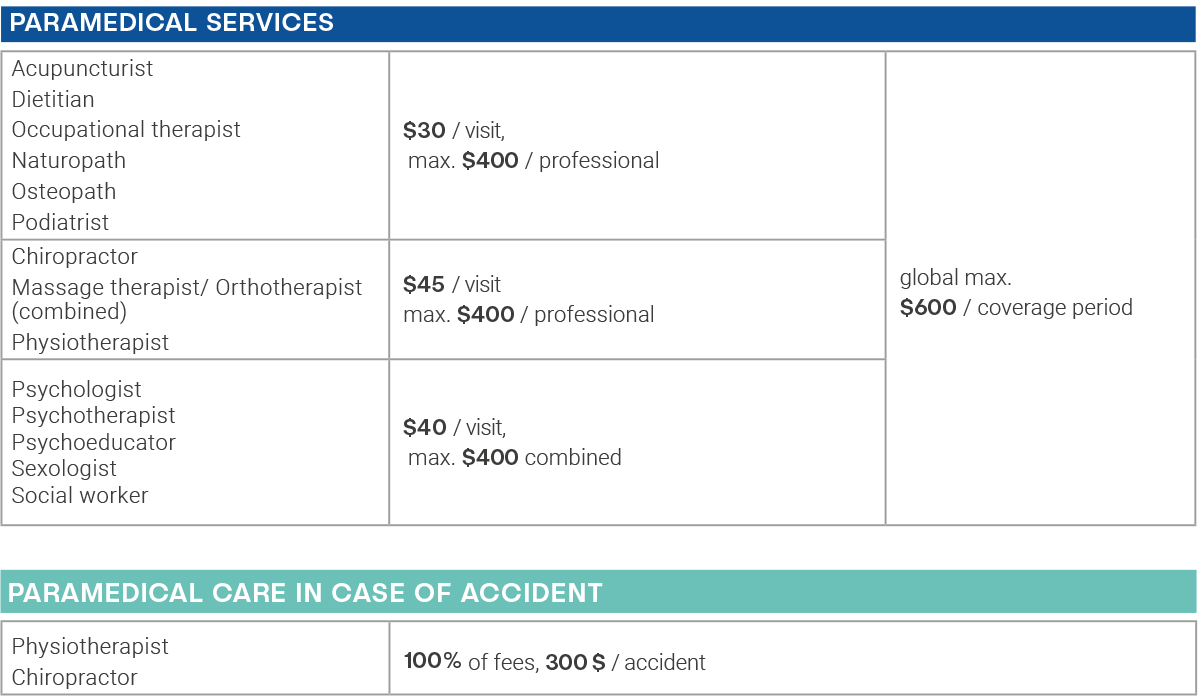

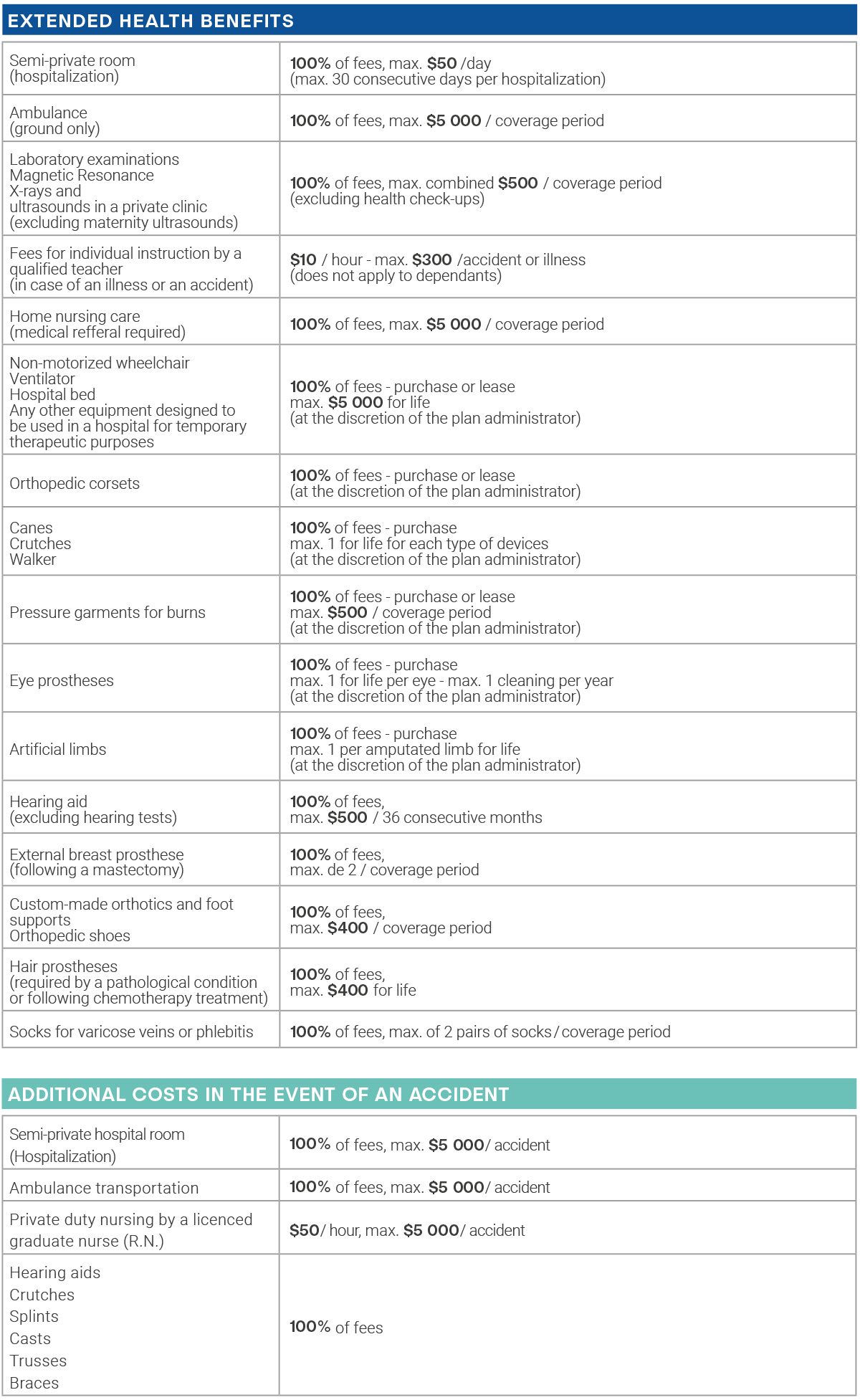

The Supplementary Health coverage provided by your student association’s plan covers several health care services not covered by the government of Québec (Régie de l’assurance maladie du Québec).

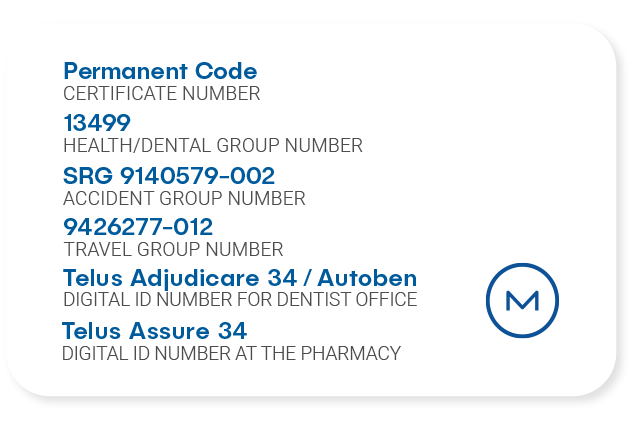

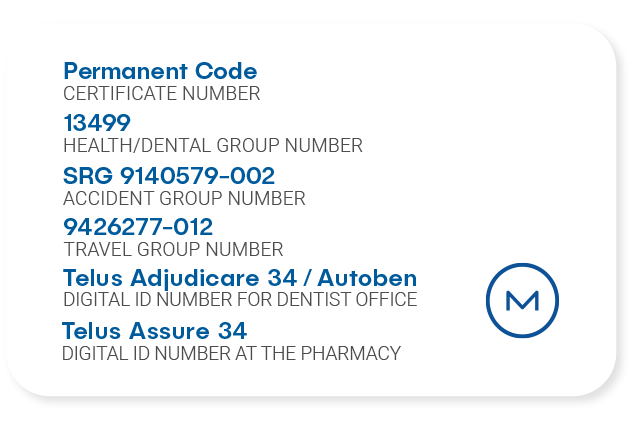

The policy number for health care claims is: 13499

Note that prescription drug is not included in the plan.

Student coverage does not replace the prescription drug coverage now required by the Quebec government. Additionally, international students must be enrolled in a prescription drug insurance plan.

Keeping your Major Plan coverage will allow you to benefit from discounts and preferential rates from partners such as Clinique Virtuelle, Énergie Cardio, Nautilus Plus, and many others. Visit the Discount Network section of our website for more details.

The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some age restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan claims department no later than 365 days after the date you received the service.

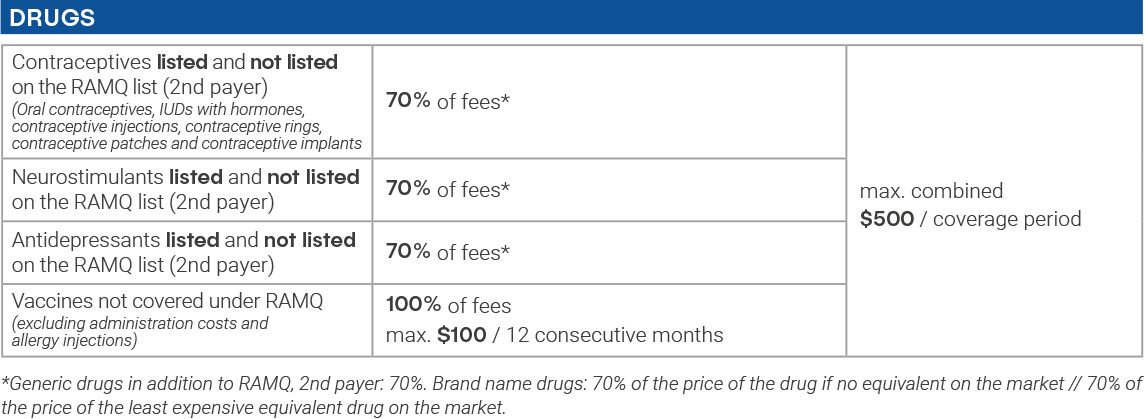

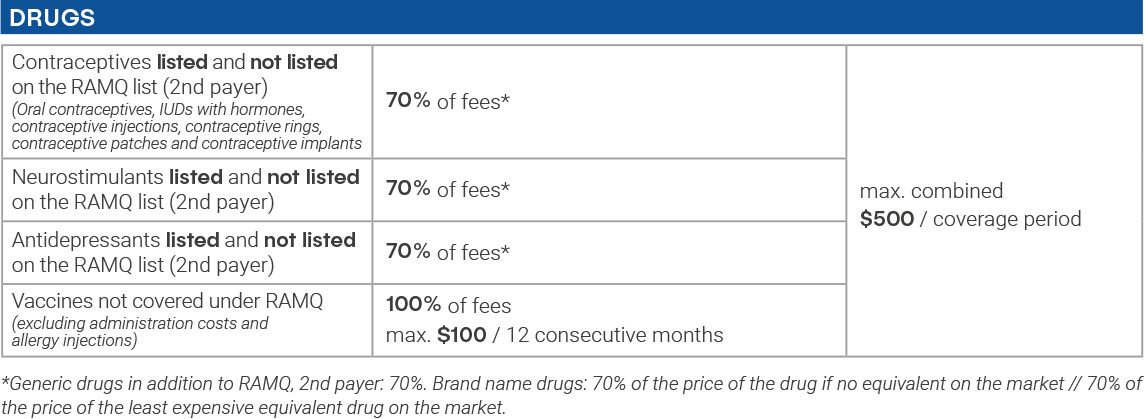

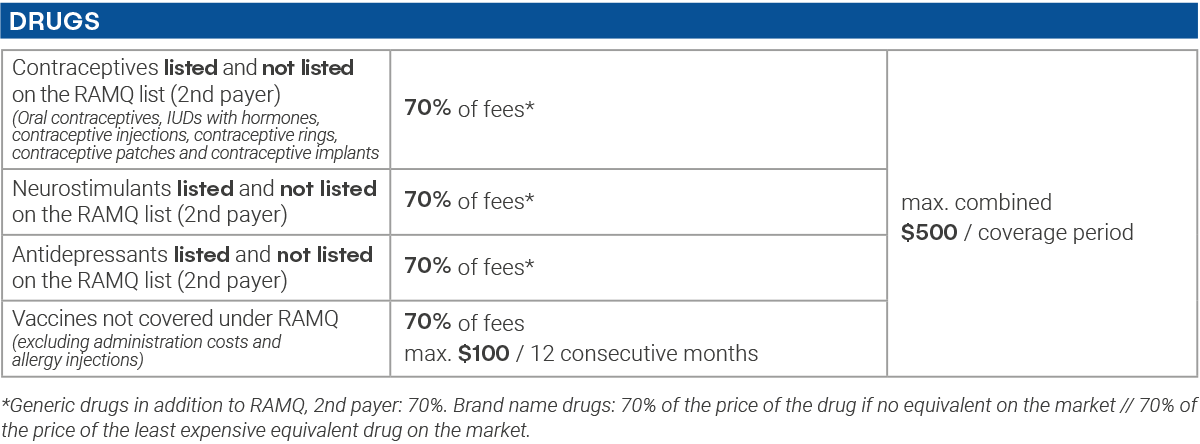

Drug Insurance

With drug coverage, you can reduce the cost of certain medications. Please note that since Major Plan is the second payer for your drug coverage, you must first submit your claims to RAMQ or another private insurance plan.

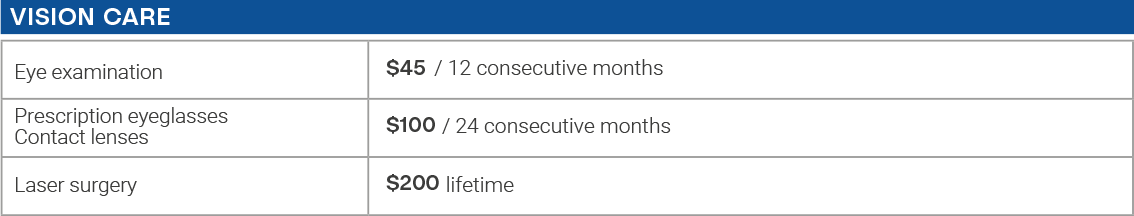

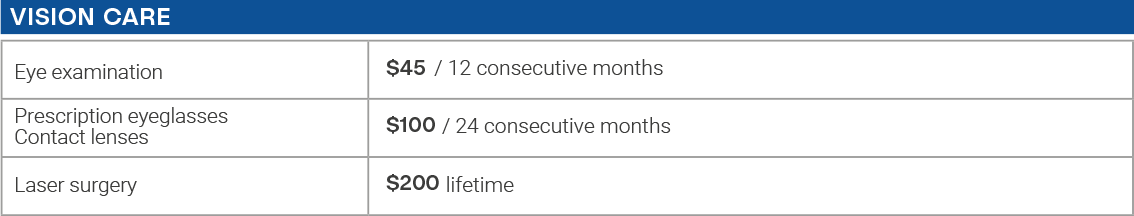

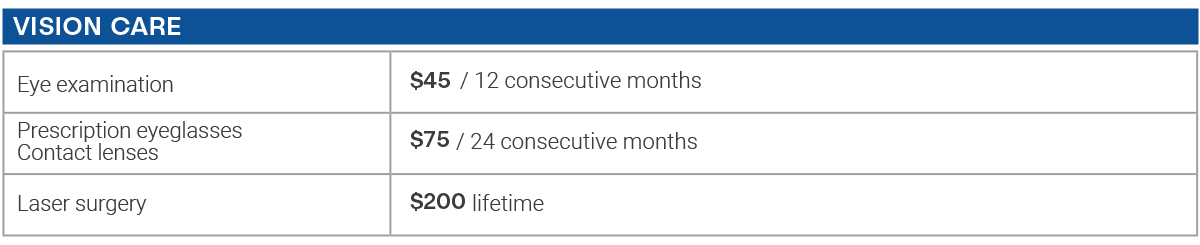

Vision

Vision coverage provides you with eye exams at a reduced cost and reduces the cost of prescription eyeglasses or contact lenses. The plan also covers laser vision surgery.

The policy number for Vision claims is: 13499

You can benefit from additional savings through our partnership with IRIS The Visual Group. Details are available in the Discount Network section. When signing up for the IRIS Advantage program, use your permanent code when prompted for a member number.

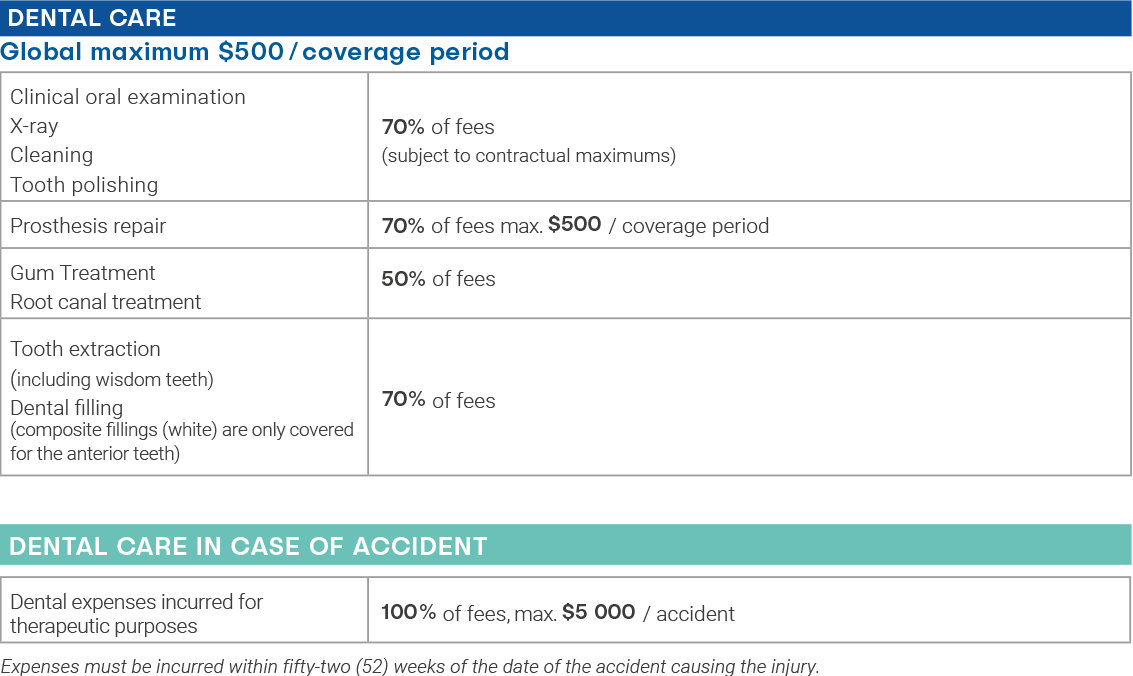

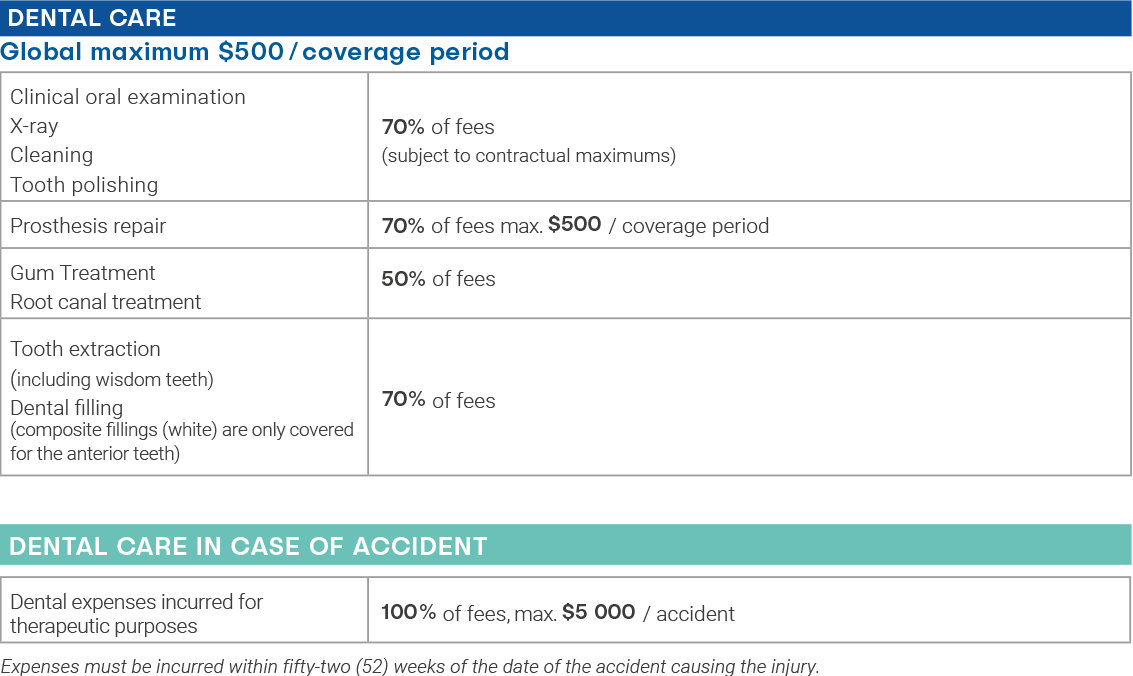

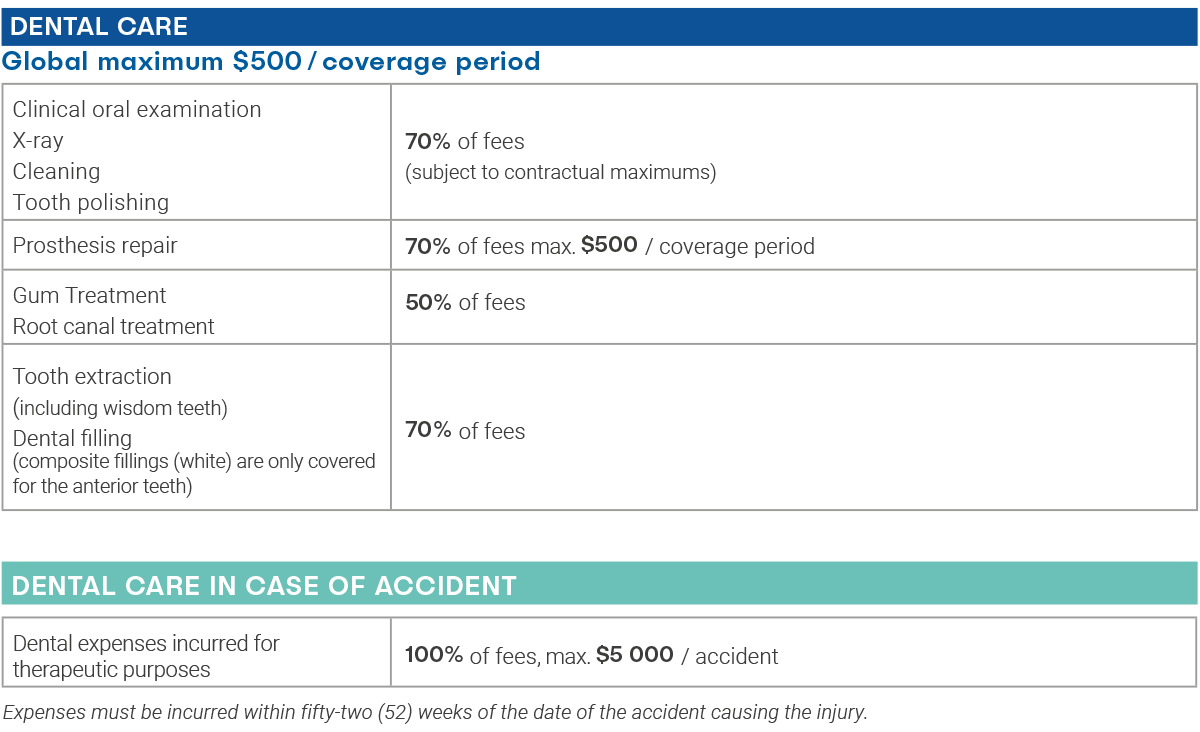

Dental Care

Thanks to coverage from your Student Plan, you may receive up to $500 in dental care reimbursements per coverage period.

The policy number for dental claims is: 13499

For claims made directly from the dentist’s office, you may need to provide the digital ID number TELUS ADJUDICARE 34 / AUTOBEN.

It is important you obtain a treatment plan from your dental care provider in order to determine coverage eligibility, particularly if the cost of the procedure exceeds $200.

Keeping your Major Plan coverage will allow you to benefit from discounts and preferential rates from Centres Dentaires Lapointe. Visit the Discount Network section of our website for more details.

Eligible costs are as determined by the Dental Association of the Canadian province where the insured individual resides (generalist rate). The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan claims department no later than 365 days after the date you received the service.

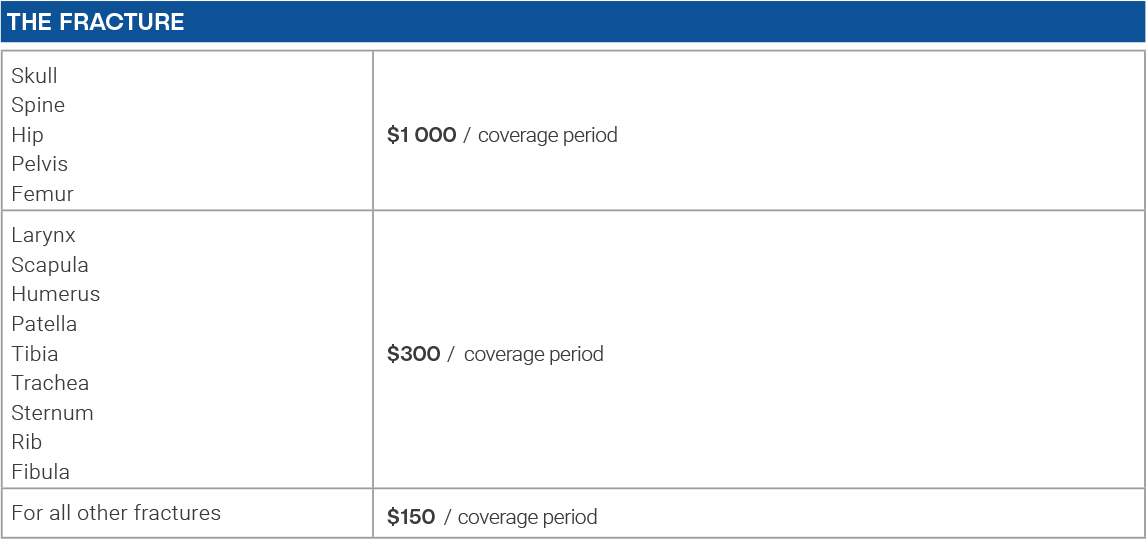

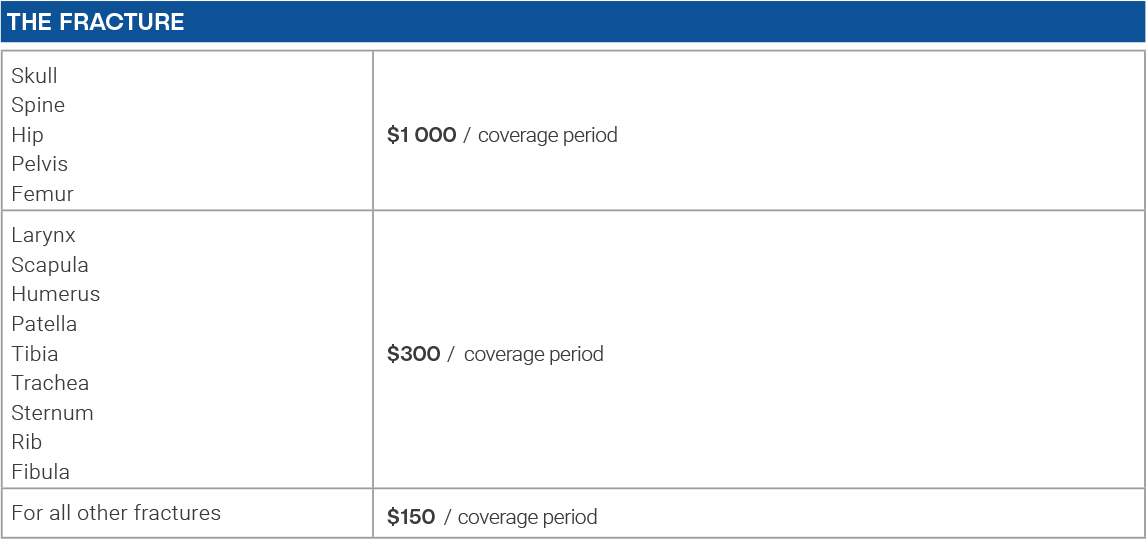

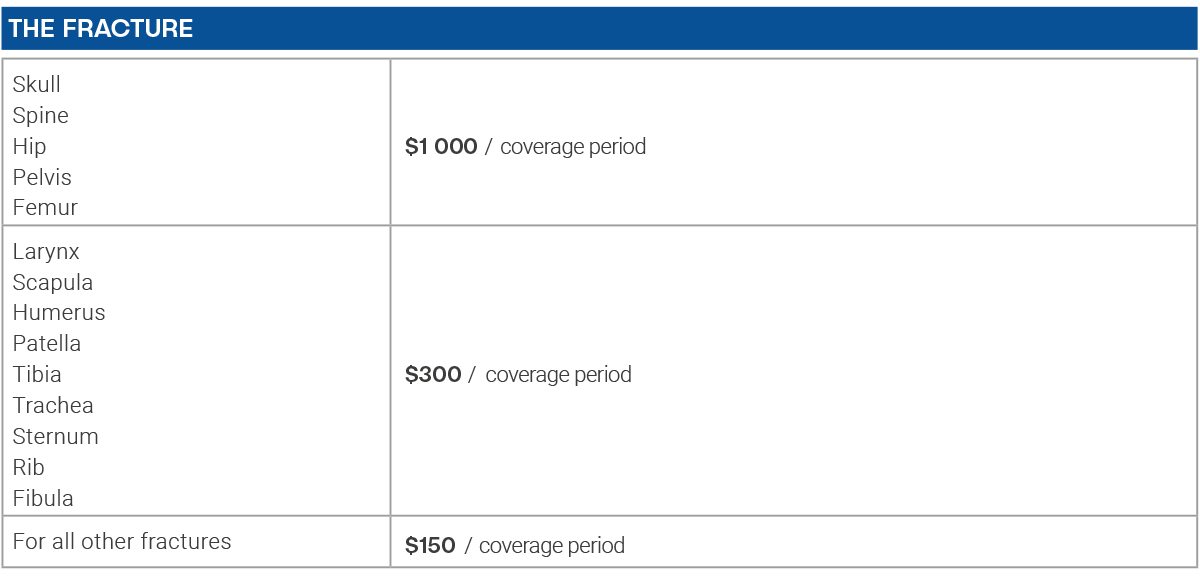

Fracture Insurance

Thanks to the coverage of your complementary student plan, you benefit from the Fracture Insurance. You can receive up to $1000 in the event of a fracture resulting from an accident. In addition, benefits are payable in addition to any other insurance held by an insurer or a government plan.

Your policy number for Fracture claims is: 13499

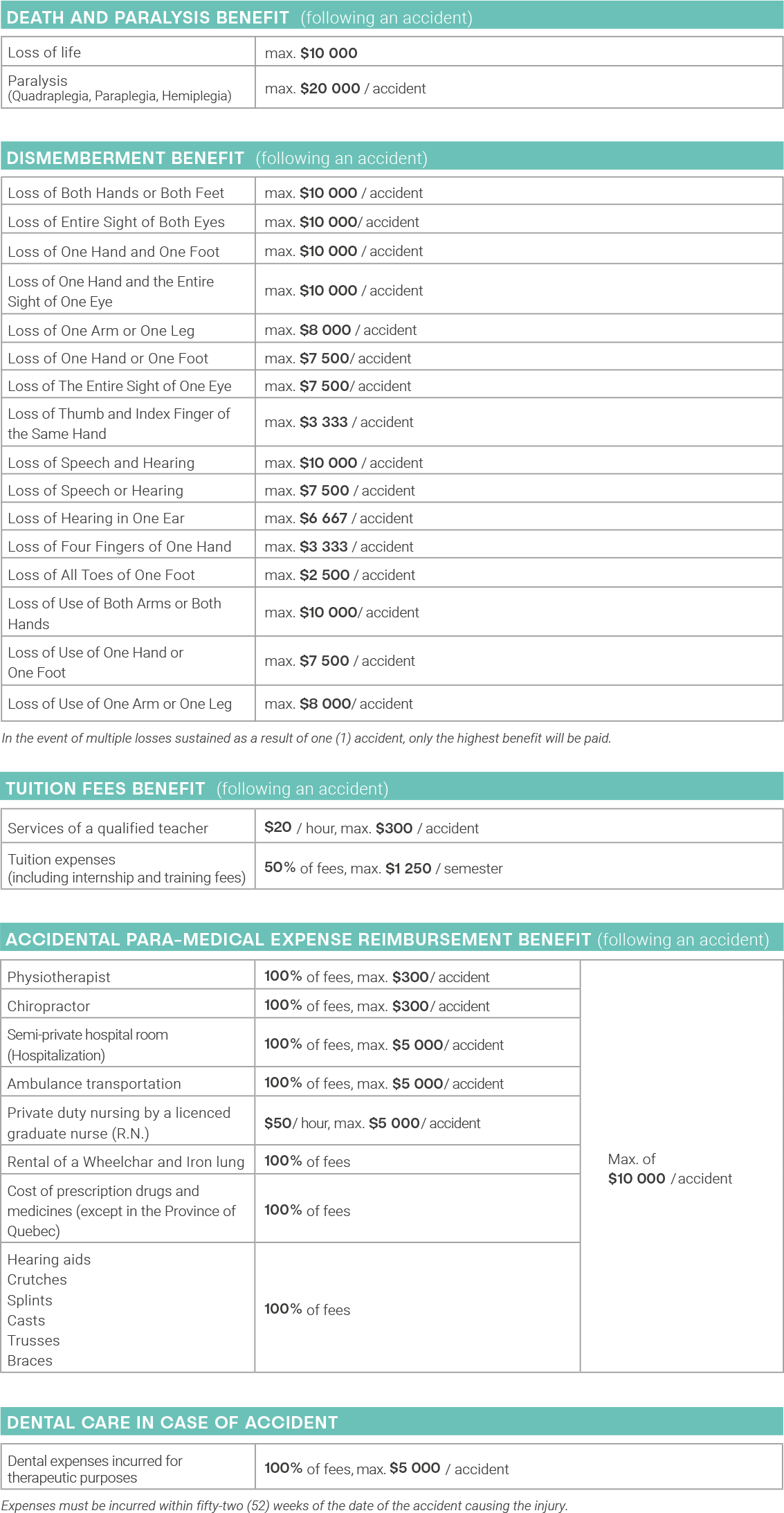

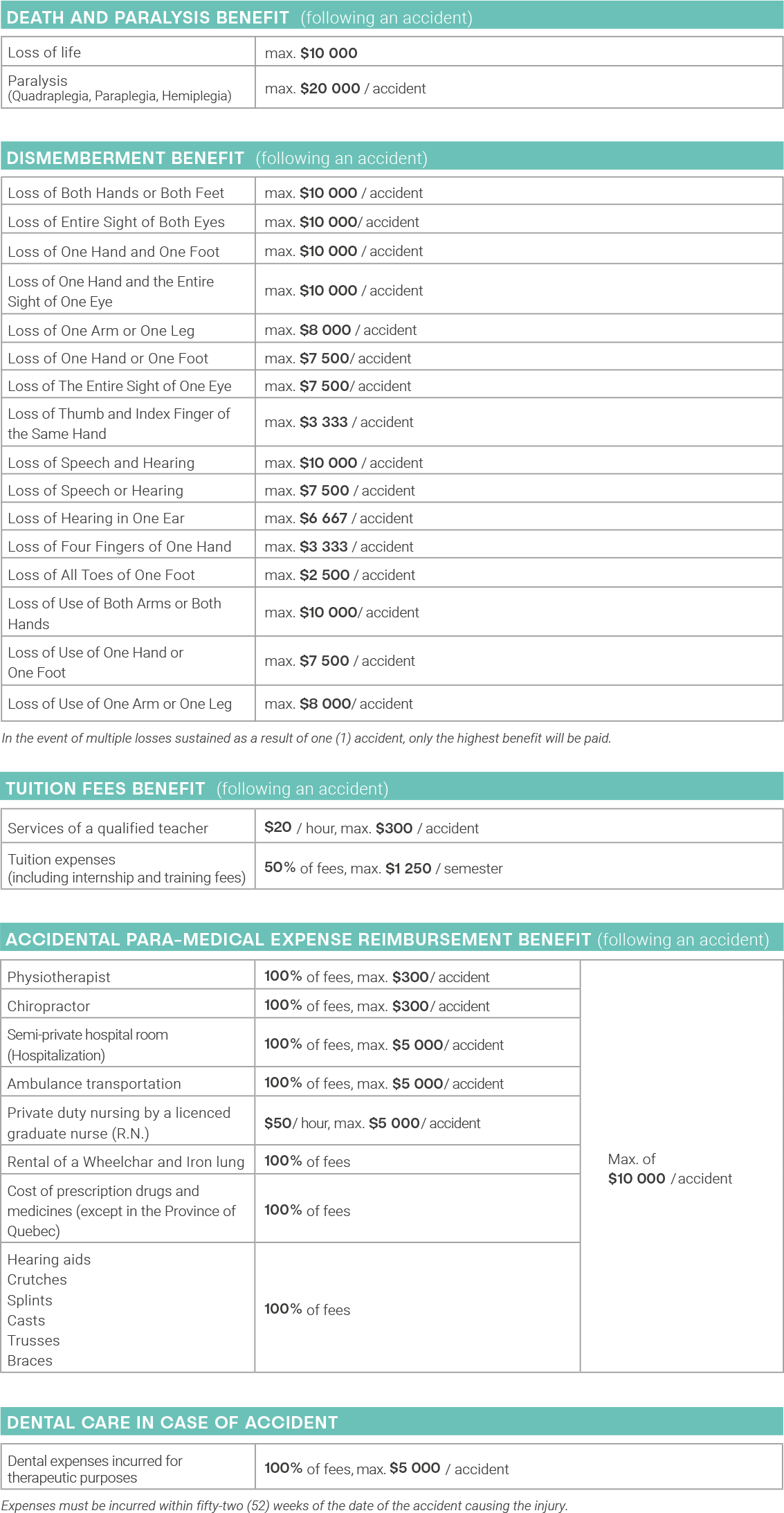

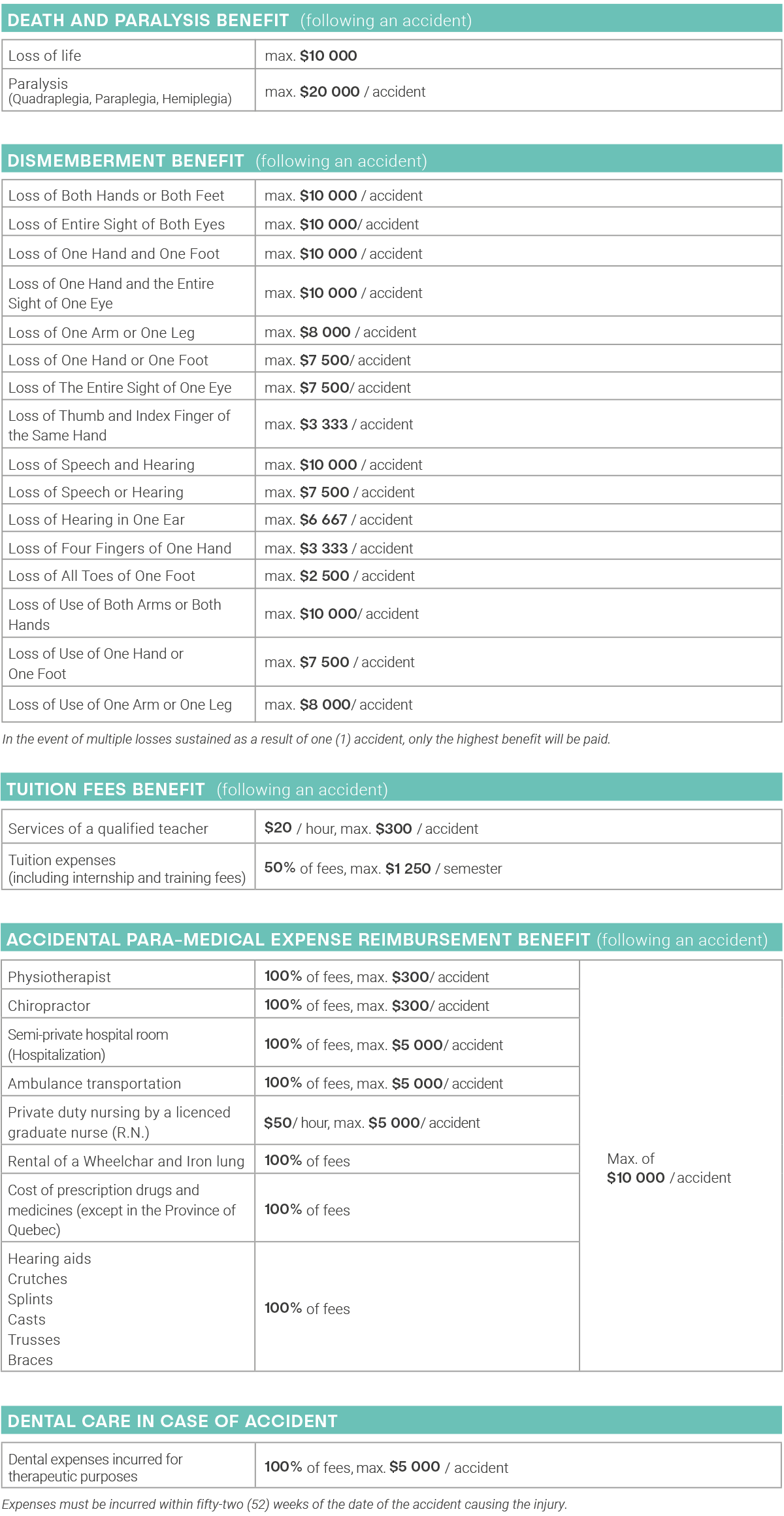

Accident Insurance

Maintaining your student plan coverage means you’ll benefit from affordable coverage in case of an accident.

Accident insurance under your plan provides benefits covering a wide range of situations, such as dental costs stemming from an accident, and health care costs.

Accident insurance also covers the costs of hospitalization, chiropractor, and physiotherapist services, allowing you to devote your energy to recovering from the accident.

Your policy number for Accident claims is: SRG 914 0579-002

What constitutes an accident?

An accident is defined as an unintentional and unplanned event caused by an external source.

Compensation in Case of Accidental Death and Dismemberment (AD&D)

Please refer to the loss schedule included in the Accident Insurance Passport for more information about reimbursement terms.

Accident Plan (coming soon)

Accident Insurance Claim

To submit a claim, please contact the AIG Insurance Company of Canada directly at 1-877-317-8060 or AHClaimscan@aig.com.

You can also contact our customer service department at 1-877-976-2567.

If your other insurance plan includes dental trauma coverage or other supplementary health care coverage, you must submit your claim to AIG in a second. However, the Major Plan team remains available to help you with the coordination of the benefits process.

Your policy number for Accident claims is: SRG 914 0579-002

Please note: Deadlines apply for submitting a claim.

| Time Between the Accident and Resulting Injury or Loss | Maximum Time Before First Reimbursement | |

|---|---|---|

| Death and Dismemberment | No more than 365 days after the accident | |

| Assessment fees, Paramedical fees, and Accident-related Dental | No more than 30 days

after the accident |

Within 52 weeks of the accident that caused the injury |

Please note that you have 90 days to submit a notice of claim after death, loss of sensation, loss of limb, or total or partial paralysis.

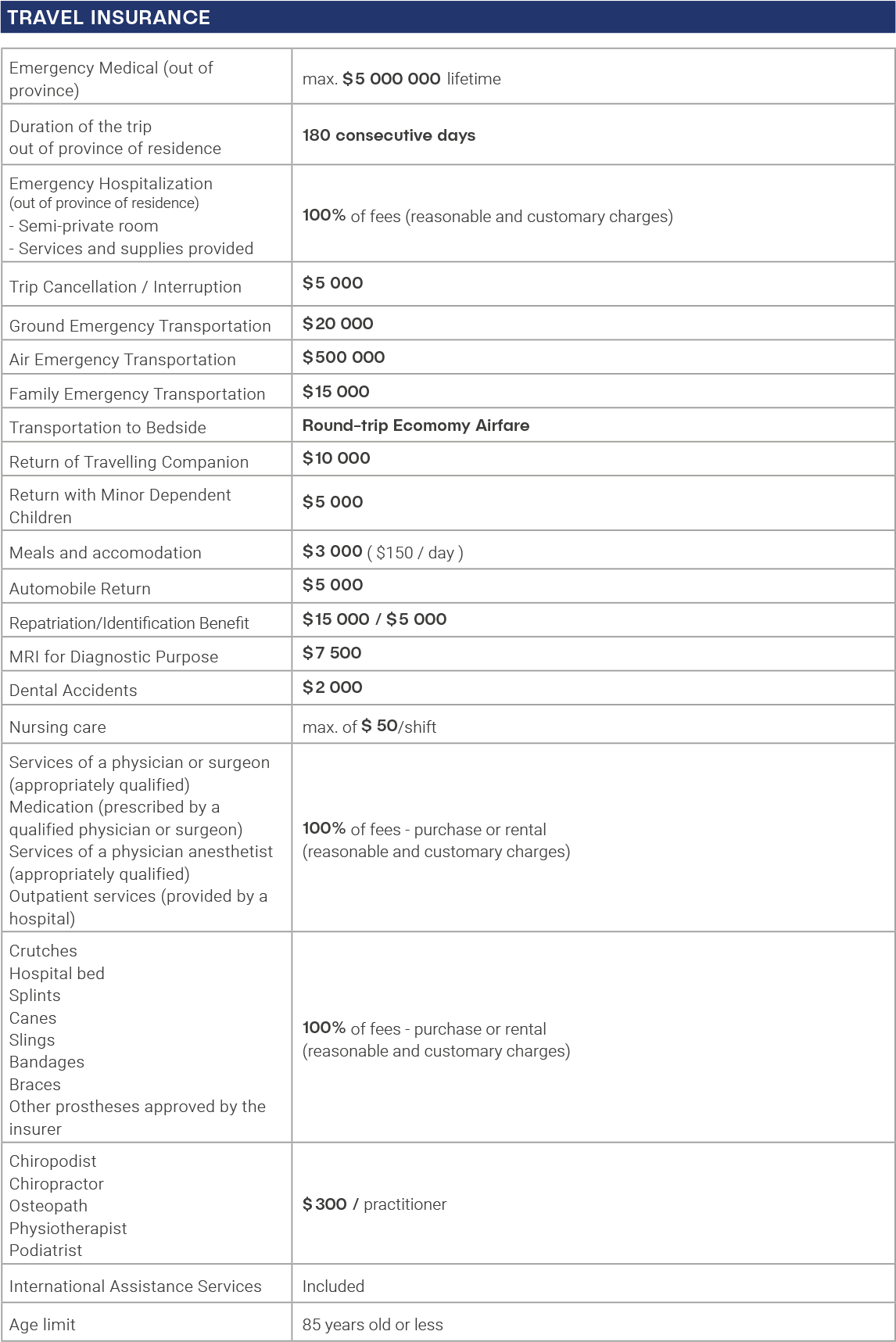

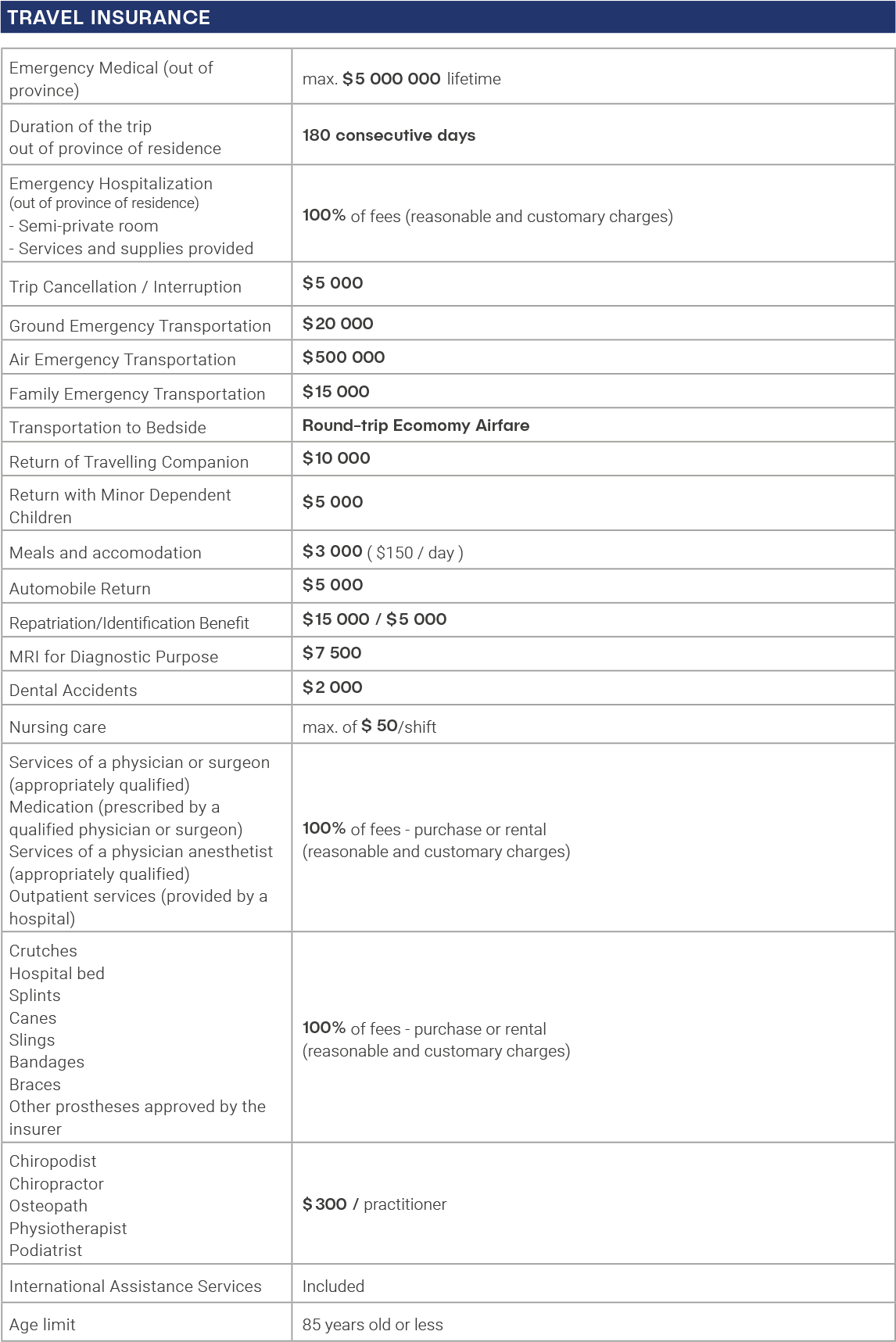

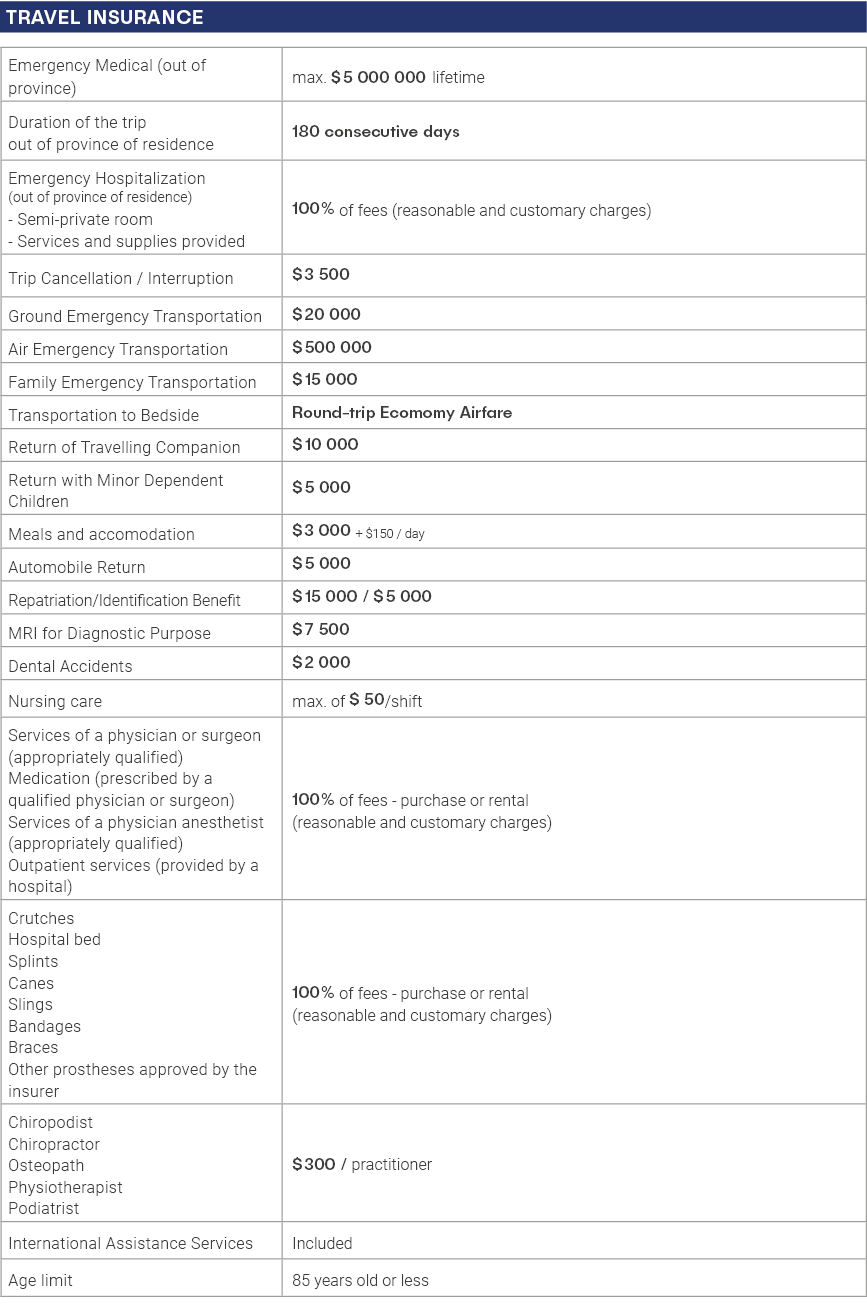

Travel Insurance

The Travel component of the Plan offers coverage for medical emergencies abroad and travel cancellations up to $5 million.

Your policy number for Travel claims is: 9426277-012

To submit a Travel insurance claim, contact AIG Insurance Company of Canada (AIG) directly at 1-877-207-5018. Coverage is valid for trips up to 180 consecutive days. In addition, travel must take place during the current coverage period.

Coverage is valid for trips up to 180 consecutive days. In addition, travel must take place during the current coverage period.

The Travel Passport is a reference to keep on hand when traveling. It provides easy access to important numbers in the event of an incident.

Travel Passport (coming soon)

Please note that students aged 86 and over are not covered by travel insurance. If you have any questions regarding travel coverage, please contact a Major Plan Client Services representative.

Coverage Offered by

Heath and dental: Humania

Accidents and travel: AIG Insurance Company of Canada

2023-2024 Coverage

The coverage period was from September 1, 2023, to August 31, 2024.

Note that prescription drug coverage is not included in your plan and does not replace the prescription drug insurance coverage required by the Quebec government

-

2023-2024 Health coverage

The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some age restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan claims department no later than 365 days after the date you received the service.

-

2023-2024 Drug Insurance

-

2023-2024 Vision coverage

The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some age restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan claims department no later than 365 days after the date you received the service.

-

2023-2024 Dental coverage

Eligible costs are as determined by the Dental Association of the Canadian province where the insured individual resides (generalist rate). The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan claims department no later than 365 days after the date you received the service.

-

2023-2024 Accident coverage

-

2023-2024 Accident coverage

Please refer to the loss schedule included in the Accident Insurance Passport for more information about reimbursement terms.

Accident Insurance Claim

To submit a claim, please contact the AIG Insurance Company of Canada directly at 1-877-317-8060 or AHClaimscan@aig.com.

You can also contact our customer service department at 1-877-976-2567.

If your other insurance plan includes dental trauma coverage or other supplementary health care coverage, you must submit your claim to AIG first. However, the Major Plan team remains available to help you with the coordination of the benefits process.

Your policy number for Accident claims is: SRG 914 0579-002

Please note: Deadlines apply for submitting a claim.

Time Between the Accident and Resulting Injury or Loss Maximum Time Before First Reimbursement Death and Dismemberment No more than 365 days after the accident Assessment fees, Paramedical fees, and Accident-related Dental No more than 30 days after the accident

Within 52 weeks of the accident that caused the injury Please note that you have 90 days to submit a notice of claim after death, loss of sensation, loss of limb, or total or partial paralysis.

-

2023-2024 Travel coverage

Please note that students aged 70 and over are not covered by travel insurance. If you have any questions regarding travel coverage, please contact a Major Plan Client Services representative.

Claims 101

Important Numbers Health and Dental Claims Drug Claims Accident and Travel Claims Previous Year’s Claims Coordination of Benefits

Please note that claims processing is paused during the change/withdrawal period.

Please note that you will be able to create your profile on the mobile application and web portal only after the amendment and withdrawal period ends.

Important Numbers

Would you like to make a claim and don’t know which numbers to use? Here’s a list of important numbers to use. This is not a sample card, but your numbers. Your certificate number corresponds to our student number, and your dental health group number is 13499.

Health and Dental Claims

There are several ways to submit a claim.

When making claims, it is important to provide your name, permanent code and your policy/group number. Additionally, by providing your direct deposit information, you will receive your payment much more quickly

Claims will be processed after the amendment and withdrawal period ends. Claims are processed within six (6) business days of document receipt.

When your tuition fees have been fully paid, you will be able to submit your claims retroactively. Your request for reimbursement must be received by Plan Major’s claims department no later than 365 days after the date you received the service. It is also not recommended to wait this long to submit your claims.

-

By Email

To submit a claim by email, scan or take a picture of your invoice (dental or paramedical) using your smartphone, and email it to claim@majorplan.ca.

Your name, your permanent code, your policy number must be included at the top of the email, as well as a void cheque. -

Via Mobile Application or Web Portal

Claims can be submitted through our mobile app and web portal. Submission of claims and uploading of receipts can be done directly from your profile. In addition, we highly recommend that you provide your banking information under “Direct Deposit” if you wish to receive your reimbursement more quickly.

You will be prompted to create an ID using your certificate number (permanent code), policy/group number, date of birth, and postal code noted in your academic file. -

Directly from the Health Care Professional

Dental offices may submit a dental claim form directly if requested. The amount of the bill could be reduced immediately, depending on the terms of the coverage. The TELUS ADJUDICARE 34 / AUTOBEN alphanumeric identifier, policy/group number, and your permanent code must be provided to the professional when the form is being filled out.

-

By Fax or Mail

Submit your claims by providing copies of your health care receipts and/or claim form by fax, or mailing them to the following address:

Major Plan

CP 70025 SUCC QUÉBEC-CENTRE,

Québec, QC, G2J 0A1Fax: 1-819-205-0714

Please ensure that your name, your permanent code, as well as your policy/group number are included in all your correspondence with us. Please note: in order to expedite the repayment of your claims, it is highly recommended that you send us a void cheque.

Watch the video to learn how to make a claim ↓

Drug Claims

Since Plan Major is the second payer for your drug coverage, you must first submit your claims to either RAMQ or another private insurer.

If you were covered by private insurance and have lost that coverage, you must register with RAMQ before sending us your claims.

Accident and Travel Claims

To file a claim for accident and travel insurance, we invite you to contact AIG Insurance Company of Canada (AIG) directly. Please note that there are two separate telephone numbers to reach them, depending on whether you are making an accident or travel claim.

-

Accident

For accident claims, you must contact AIG at 1 877 317-8060. Please note that accident coverage always applies second when you already have health coverage. If in doubt, don’t hesitate to contact us. We’ll be happy to refer you and help you through the process. Please ensure that your name, your permanent code, and your policy/group number are included in all your correspondence with AIG.

-

Travel

For travel claims, please contact AIG directly at 1 877 207-5018. Please ensure that your name, your permanent code, and your policy/group number are included in all your correspondence with AIG.

Previous Year’s Claims

You may submit your claims within 365 days of the date the service was received. For example: If you consulted a health specialist on October 13, 2023, you have until October 13, 2024 to submit a claim for this service.

Refer to the coverage in effect at the time the service was obtained to determine the eligible claim amount.

Coordination of Benefits

Since you may be already covered by another insurance plan, your association offers you a supplemental insurance plan that allows the coordination of benefits for which you are eligible. Coordination of benefits allows you to combine the benefits and services from your student plan with those received from your parents’, your spouse’s, or your employer’s plan. It is important to confirm the existence of other coverages and to compare them. Claims for reimbursement can be made to multiple plans, however, the total sums received under all claims may not exceed 100% of the costs incurred. For this reason, it is important to determine the order in which claims should be submitted to your various group plans to coordinate benefits.

The order in which claims are submitted to multiple group plans is determined by your coverage type.

- Policyholder: your employers’ or student association’s plan.

- Dependent and Spouse: your parents’ or your spouse’s employers’ plan.

-

Coordination with Your Employer’s Plan

The procedure to coordinate your student association’s plan with your employer’s plan is as follows:

1. Submit your health or dental claim to your employer’s plan’s insurance company, making sure to keep a copy of the receipts if submitted by mail.

2. Once the claim is processed, you will receive a “Statement of Benefits” from your employer’s insurance company.

3. Submit your claim to Major Plan along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. Major Plan will send you the eligible amount, and the second “Statement of Benefits” will be available for download from the web portal. -

Coordination with Your Parents’ or Spouse’s Plan

The procedure to coordinate your student association’s plan with your parents’ or spouse’s plan is as follows:

1. Submit your health or dental claim to Major Plan, making sure to keep a copy of the receipts if submitted by mail.

2. Once the claim is processed, download the “Statement of Benefits” from the Major Plan web portal.

3. Submit your claim to your parents’ or spouse’s plan’s insurance company along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. Your parents’ or spouse’s insurance company will send you the eligible amount along with a second “Statement of Benefits.” -

Coordination with Two (2) Student Supplemental Plans

You may be studying in two (2) educational institutions and benefit from a supplemental insurance plan for both. If this is the case, the procedure to coordinate both of your student association’s plans may vary according to your student status (full-time or part-time). Full-time or part-time student status is established by your educational institution.

If you have FULL-TIME student status with one of your educational institutions, and PART-TIME status with the other:

1. Submit your health or dental claim to the plan insurance company for the educational institution in which you have FULL-TIME student status, making sure to keep a copy of the receipts if submitting by mail.

2. Once the claim is processed, you will receive a “Statement of Benefits” from this educational institution’s insurance company.

3. Submit your claim to the plan insurance company for the educational institution in which you have PART-TIME student status along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. The above educational institution’s insurance company will send you the eligible amount along with a second “Statement of Benefits.If you have the same student status in all your educational institutions FULL-TIME/FULL-TIME or PART-TIME/PART-TIME:

When your student status is the same in both of your educational institutions, the order of precedence for the 1st payer is determined according to the coverage start date of the oldest plan.

1. Submit your health or dental claim to the insurance company for the educational institution whose plan’s coverage start date is the oldest, making sure to keep a copy of the receipts if submitting by mail.

2. Once the claim is processed, you will receive a “Statement of Benefits” from the educational institution’s plan insurance company.

3. Submit your claim to your second plan’s insurance company along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. The above insurance company will send you the eligible amount along with a second “Statement of Benefits.”If the precedence of the first payer cannot be established, your claim will be subject to a proration of the benefits, meaning that the benefits paid by the insurance plans are calculated according to the amount that would be paid by each plan if it was 1st payer. For more information, contact customer service.

EXAMPLE: Eligible dental costs $70

Plan A (Co-insurance 70%): Liability as 1st payer $49

Plan B (Co-insurance 60%): Liability as 1st payer $42

By adding the sums that would be paid by both plans as 1st payer, we get: $48 + $42 = $91 But the total sums received under both plans may not exceed the eligible costs of $70.

Plan A (proration: $49 divided by $91 = 53.85%): Benefit paid $37.70

Plan B (proration $42 divided by $91 = 46.15%): Benefit paid $32.30

-

Take Careful Note

Since you may be covered by more than one insurance plan, it is important that you inform your other insurance carrier. The total sums received under all your plans for a given item, service received, or care claimed may not exceed 100% of the eligible costs. In some cases, the total sums received under all your plans may be lower than the costs incurred for a given item, service received, or care claimed.

Failure to provide all the information required for the proper assessment of your file, whether intentional or not, may result in the termination of your coverage plan.

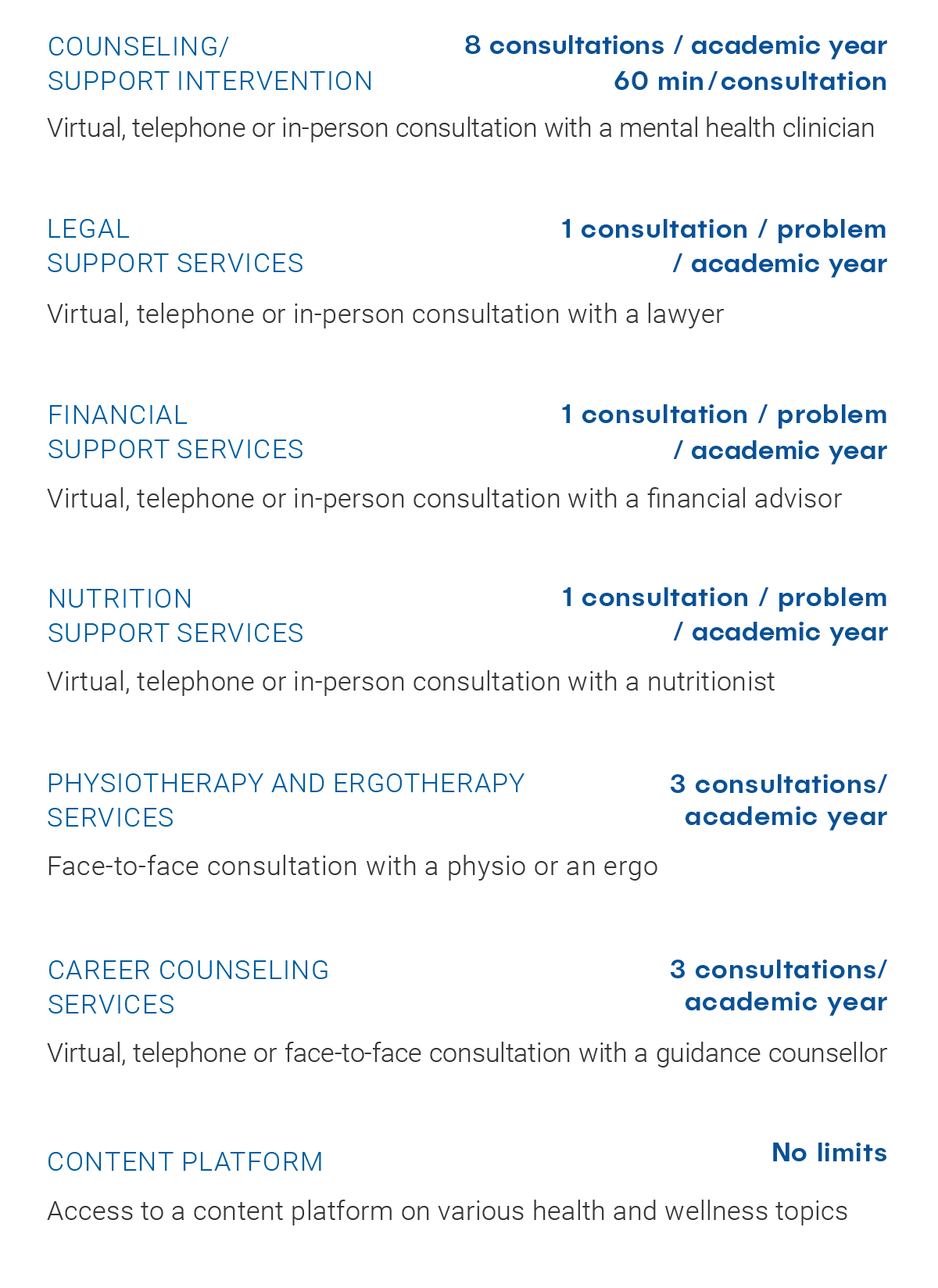

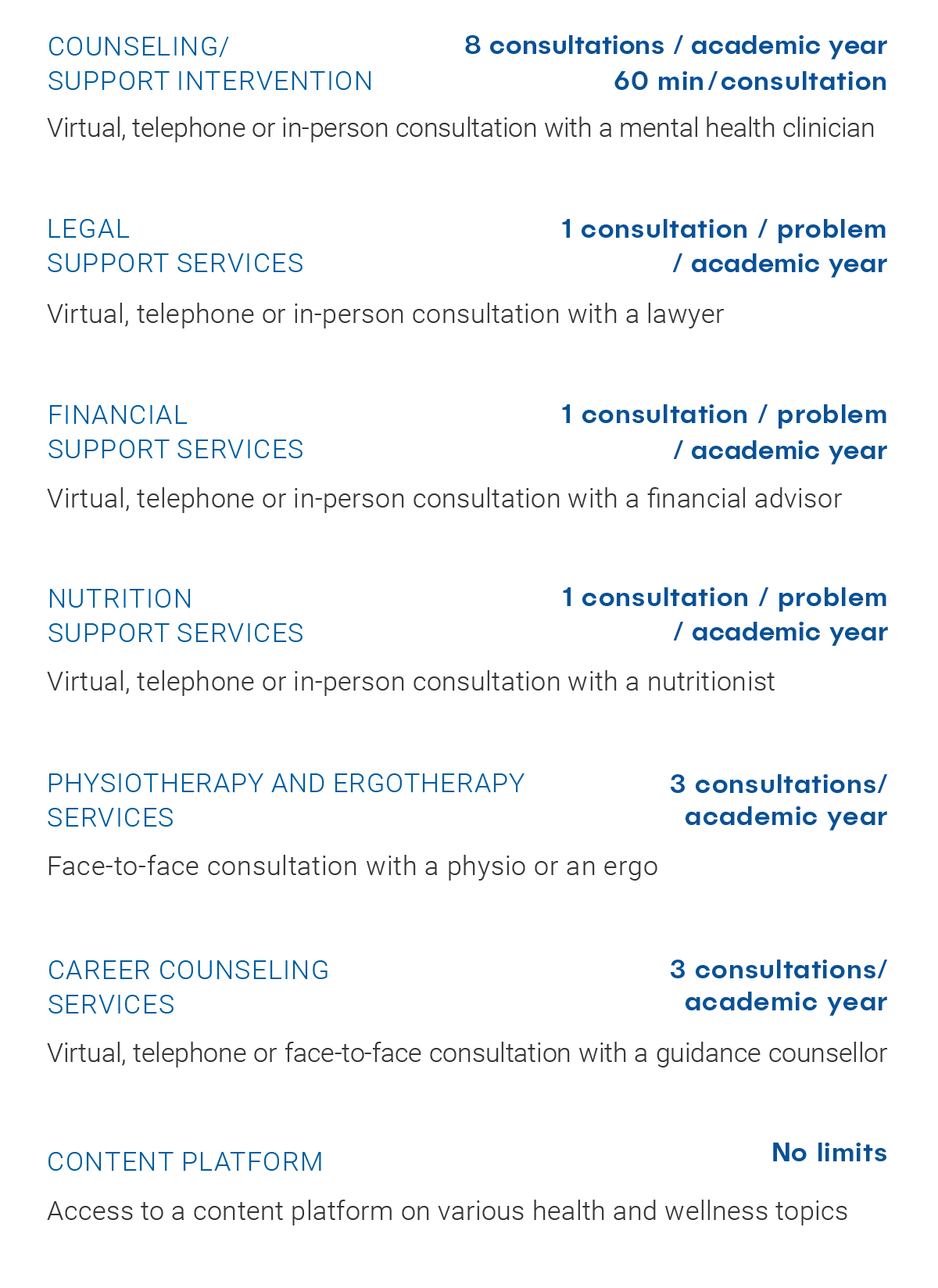

Student Assistance Program

Offered Services How does it work? Content Library

The primary function of the Assistance Program is to provide psychological support to all members of the student body.

Huni PAE’s Student Assistance Program (SAP) gives you access to a 24/7 support center. In addition to immediate support, this confidential service provides short-term consultations with qualified specialists. What’s more, the EAP makes available an online toolkit to give you easy access to advice, support and varied digital content on a variety of topics. For direct access to the service, call 1-888-781-7274.

Offered Services

How does it work?

To access the assistance program, please call 1-888-781-7274 or e-mail info@hunipae.ca.

Step 1

Contact the help line

Dial the Helpline number, initiate a discussion with a Huni PAE contact person by phone at 1-888-781-7274 or by e-mail at info@hunipae.ca. You’ll need to provide your 13499 health/dental group number and your certificate number (permanent code) when you call.

Step 2

Contact with the specialist

You will then be put in touch with the type of specialist you require. He or she will be able to arrange a time for your next session.

Step 3

Appointment with the specialist

According to the established schedule, you will be able to benefit from your consultation. You can also schedule other appointments if necessary.

Forms and Other Documentation

Below, you will find useful information such as coverage contracts, limitations, and the information management policy.

-

Brochures from Previous Years

-

Forms

-

Coverage Contracts

-

Limitations and exclusions

-

Information Documents

-

Student Assistance Program

-

Coverage offered by

Heath and dental: Humania

Accidents and travel: AIG Insurance Company of Canada

Withdrawal

Types of Withdrawal Withdrawal Period Request for Withdrawal

Enrollment in the student supplemental group insurance plan is automatic. However, you may opt out, free of charge, during the plan’s amendment and withdrawal period.

Types of Withdrawal

Annual withdrawal–Annual withdrawal allows temporarily withdrawal from the plan for the current year. At the beginning of the following year, coverage is automatically reinstated, so you will have the opportunity to choose between maintaining the plan or withdrawing again during the plan’s amendment and withdrawal period.

Permanent withdrawal–Permanent withdrawal permanently withdraws you from the plan for the duration of your academic career. As a result, it will not be necessary to withdraw every year, but coverage will not be reinstated, except under certain conditions.

-

Students enrolled in the Winter semester

A student registered in the winter semester, regardless of whether he or she chooses to retain, modify or withdraw in the winter, will have to make the modification or withdrawal again the following fall. Similarly, the steps to add dependents must be done again.

Please note that you will be able to create your profile on the mobile application and web portal only after the end of the amendment and withdrawal period.

Amendment and Withdrawal Period

Fall Semester – August 15th to September 30th

Winter Semester – January 1st to January 31st

Request for Withdrawal

The withdrawal request must be made within the prescribed time frame. You will have no other opportunity to exercise your opt-out option.

Procedure

To opt-out of the Supplementary Insurance Plan, please go directly to your institution’s student portal.