Your plan from SLCSA

The Plan

Plan Enrollment Family CoverageTravel Assistance FAQ

You are automatically enrolled in a student supplemental group insurance plan through your student association. For less than $5/month you can benefit from an advantageous coverage, in addition to a host of discounts and preferential rates from our Discount Network.

However, if you do not wish to take advantage of these benefits, you may opt-out of the plan during the coverage amendment and withdrawal period. You may already be covered by another insurance plan, so it is important that you confirm your coverages, compare them, and that you consider the option to combine benefits before your withdrawal. For more information on the coordination of benefits, please refer to the Claims 101 section.

SLCSA provides you with extended health insurance, dental, as well as accident and travel insurance.

Plan Enrollment

The plan enrollment fees are included in your tuition invoice. It is billed in two installments: the first in the Fall semester, and the second in the Winter semester. All academic fees for the current semester must be paid before you can receive reimbursement.

| Health, Dental, Accident, and Travel | College Admin. Fee Non-refundable |

Total | |

|---|---|---|---|

| Fall Sept 1st to Jan 31st |

$27.00 | $2.00 | $29.00 |

| Winter Feb 1st to Aug 31st |

$27.00 | $2.00 | $29.00 |

| Annual Individual Total | $54.00 | $4.00 | $58.00 |

If applicable, fees include premiums, administration fees, commissions, withholdings, and taxes that may apply to the plan.

Family Coverage

Any change to your plan, whether withdrawal, the addition of dependents (children and/or spouse), or amendment to coverage options, must be made during the amendment period.

Amendment Period:

Fall Semester – August 25th to September 24th

Winter Semester – January 27th to February 26th

To do so, please complete and forward the Family Coverage form for your dependents before the end of the modification period. Our team will then analyze the application received and contact you within 5 business days. Wait for the confirmation of a member of our team to know the amount of the contribution to be paid as well as the payment terms.

| Health, Dental, Accident, and Travel | |

|---|---|

| Adding Dependents (same coverage as the policyholder) |

$ 58.00 / person |

Travel Assistance

Here is the phone number to contact for travel insurance assistance.

Travel Insurance Assistance 1 877.207.5018

FAQ (Coming Soon)

Coverage Offered by

Heath and Dental: Assumption Life

Accidents and Travel: AIG Insurance Company of Canada

Coverage

2024-2025 Coverage

Coverage Period

The coverage period is divided into two periods: September 1, 2024, to August 31, 2025. In order to be eligible for both, you must maintain your student status and student association membership for both periods.

Fall: September 1 to January 31

Winter: February 1 to August 31

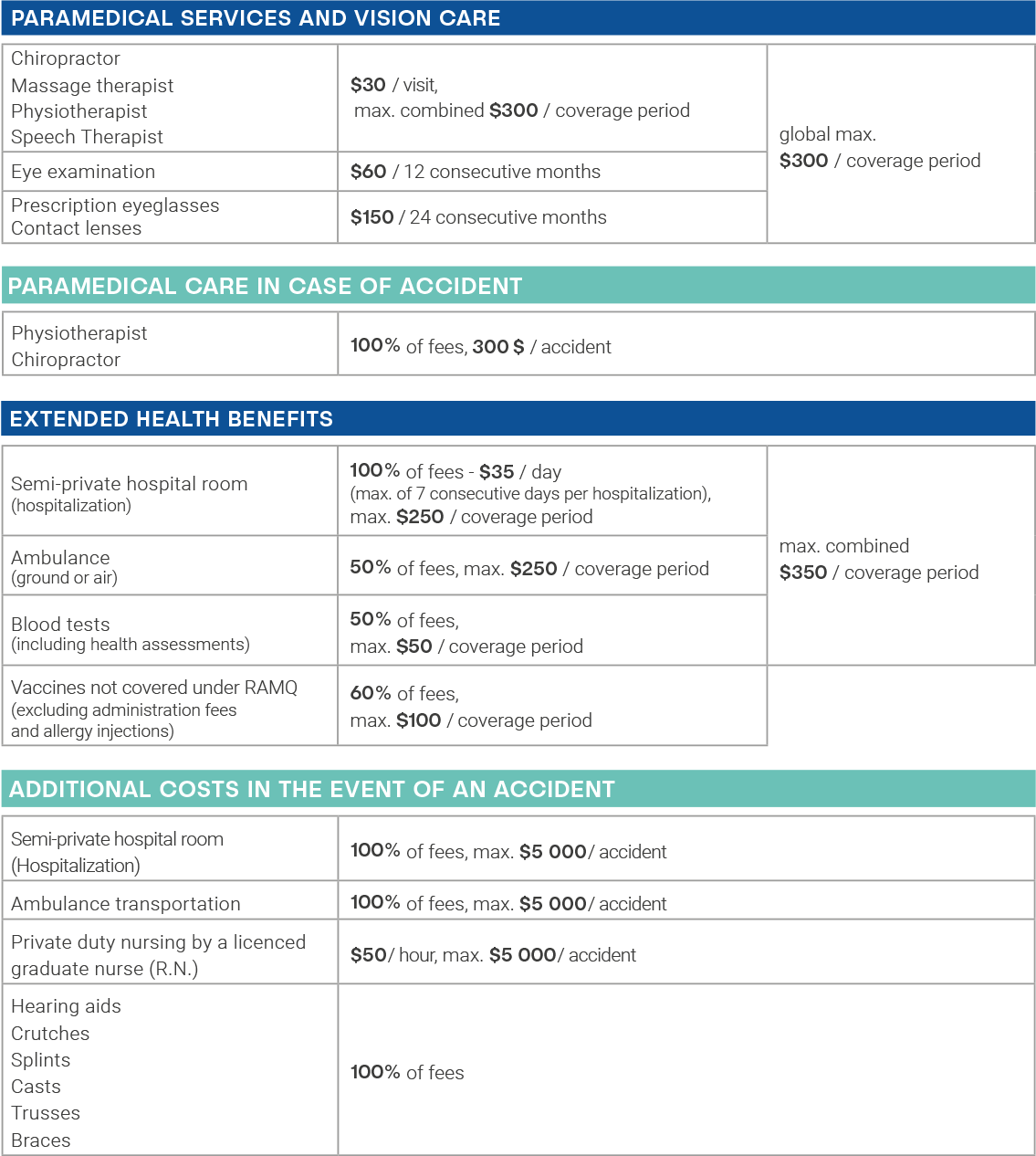

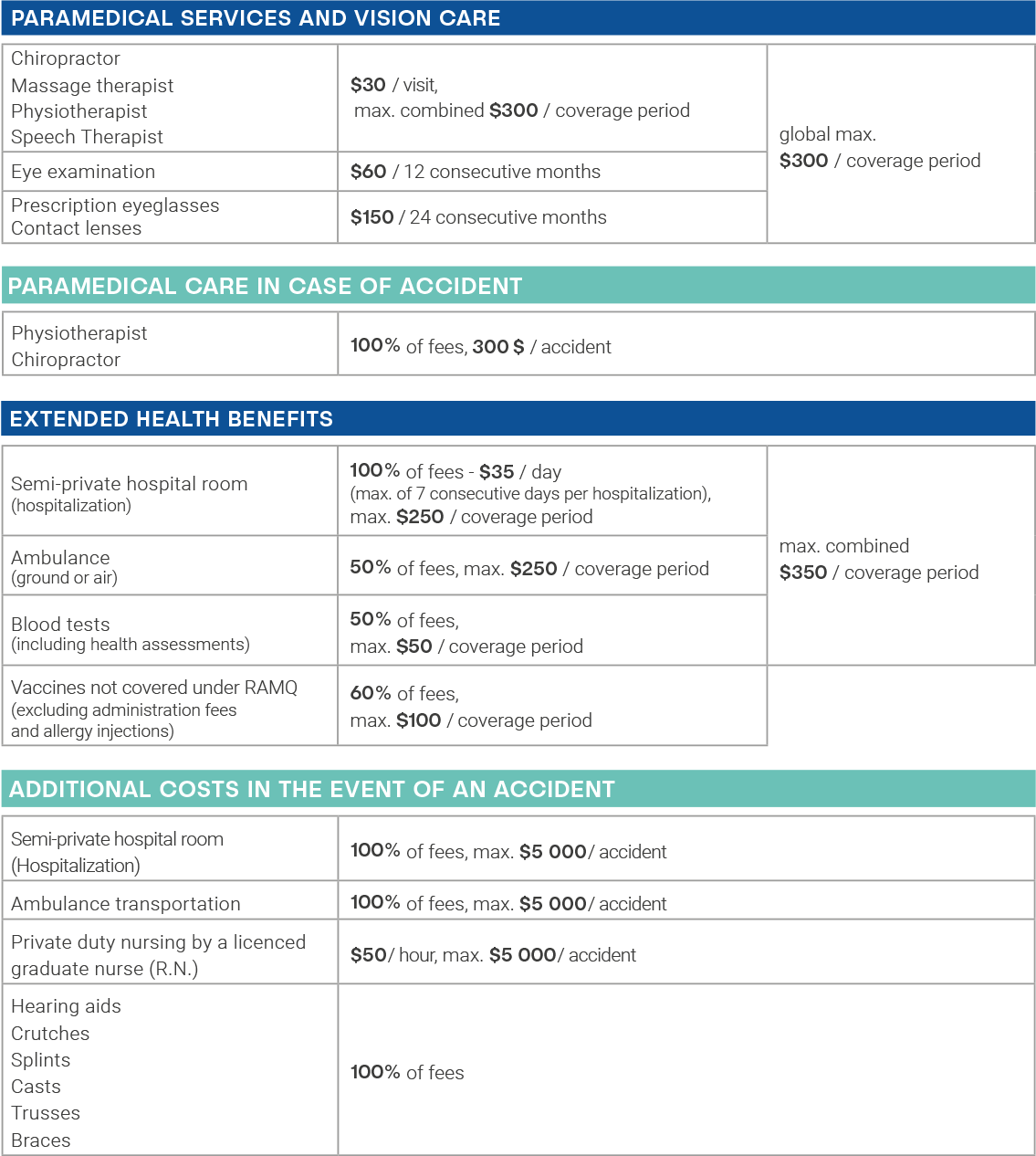

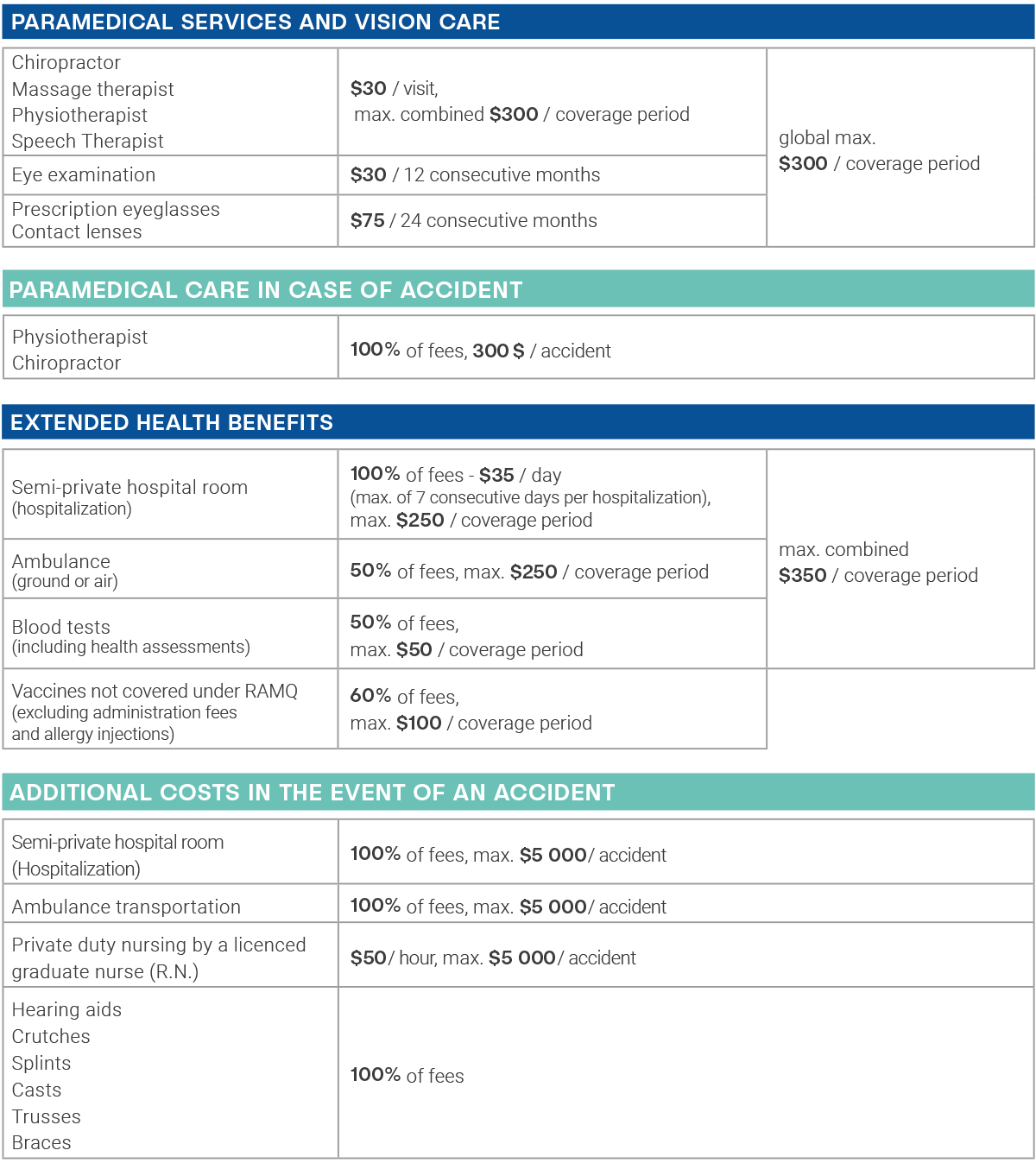

Health Care

The Supplementary Health coverage provided by your student association’s plan covers several health care services not covered by the government of Québec (Régie de l’assurance maladie du Québec).

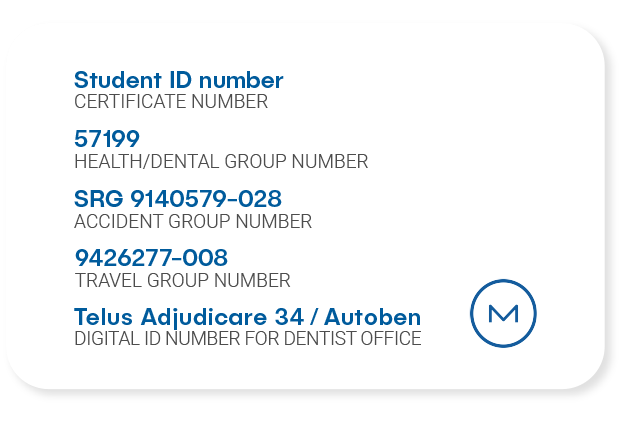

The policy number for health care claims is: 57199

Note that prescription drug is not included in the plan.

Student coverage does not replace the prescription drug coverage now required by the Quebec government.

Keeping your Major Plan coverage will allow you to benefit from discounts and preferential rates from partners such as Clinique Virtuelle, Énergie Cardio, Nautilus Plus, and many others. Visit the Discount Network section of our website for more details.

The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some age restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major claims department no later than 365 days after the date you received the service.

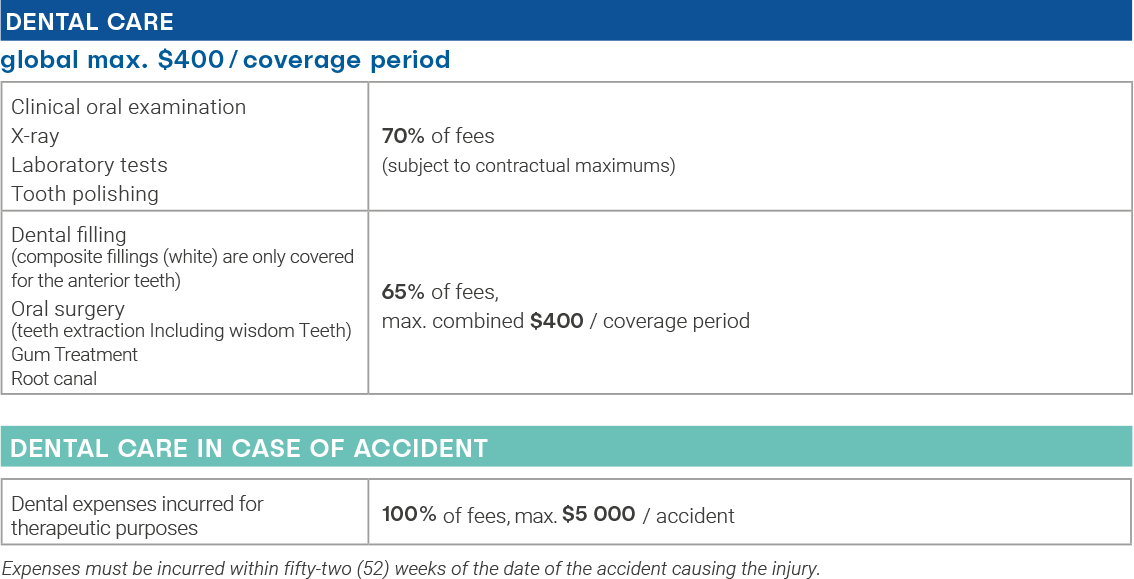

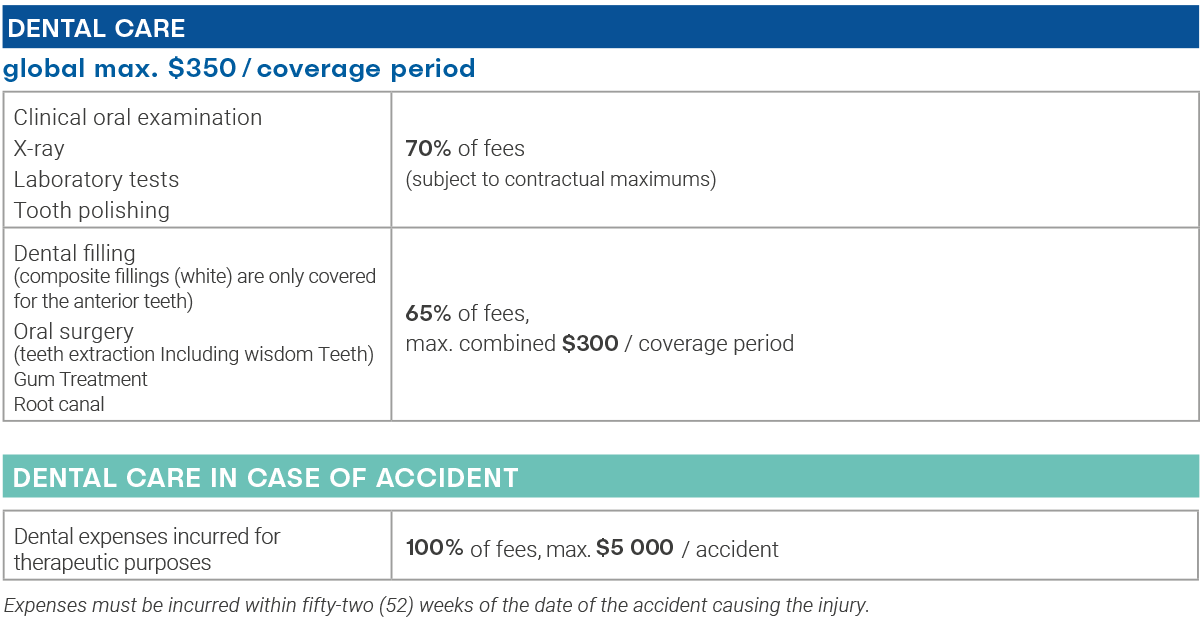

Dental Care

Thanks to coverage from your Student Plan, you may receive up to $350 in dental care reimbursements per coverage period.

The policy number for dental claims is: 57199

For claims made directly from the dentist’s office, you may need to provide the digital ID number TELUS ADJUDICARE 34 / AUTOBEN.

It is important you obtain a treatment plan from your dental care provider in order to determine coverage eligibility, particularly if the cost of the procedure exceeds $200.

Keeping your Major Plan coverage will allow you to benefit from discounts and preferential rates from Centres Dentaires Lapointe. Visit the Discount Network section of our website for more details.

Eligible costs are as determined by the Dental Association of the Canadian province where the insured individual resides (generalist rate). The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan’s claims department no later than 365 days after the date you received the service.

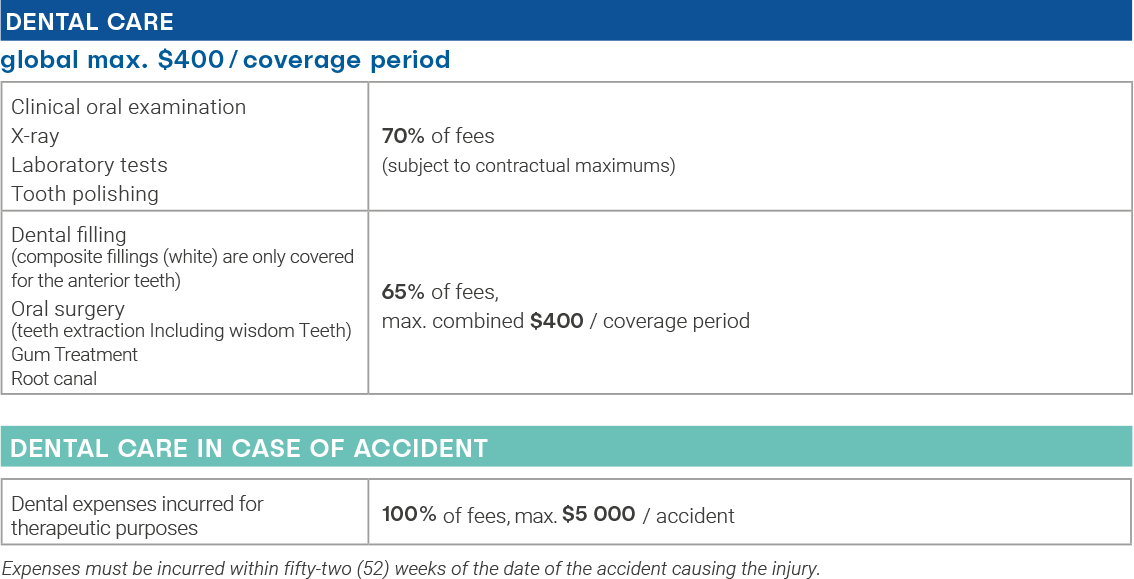

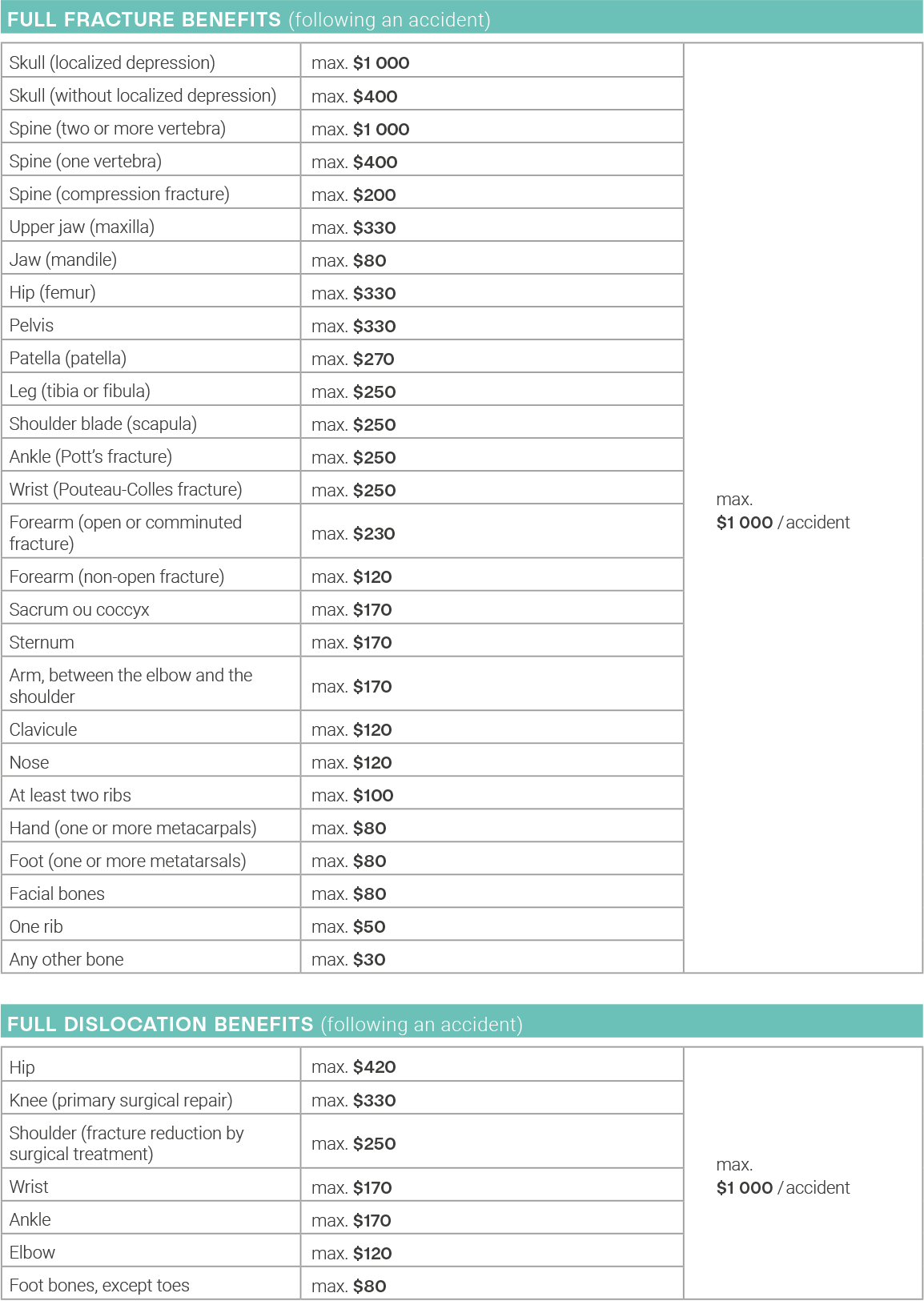

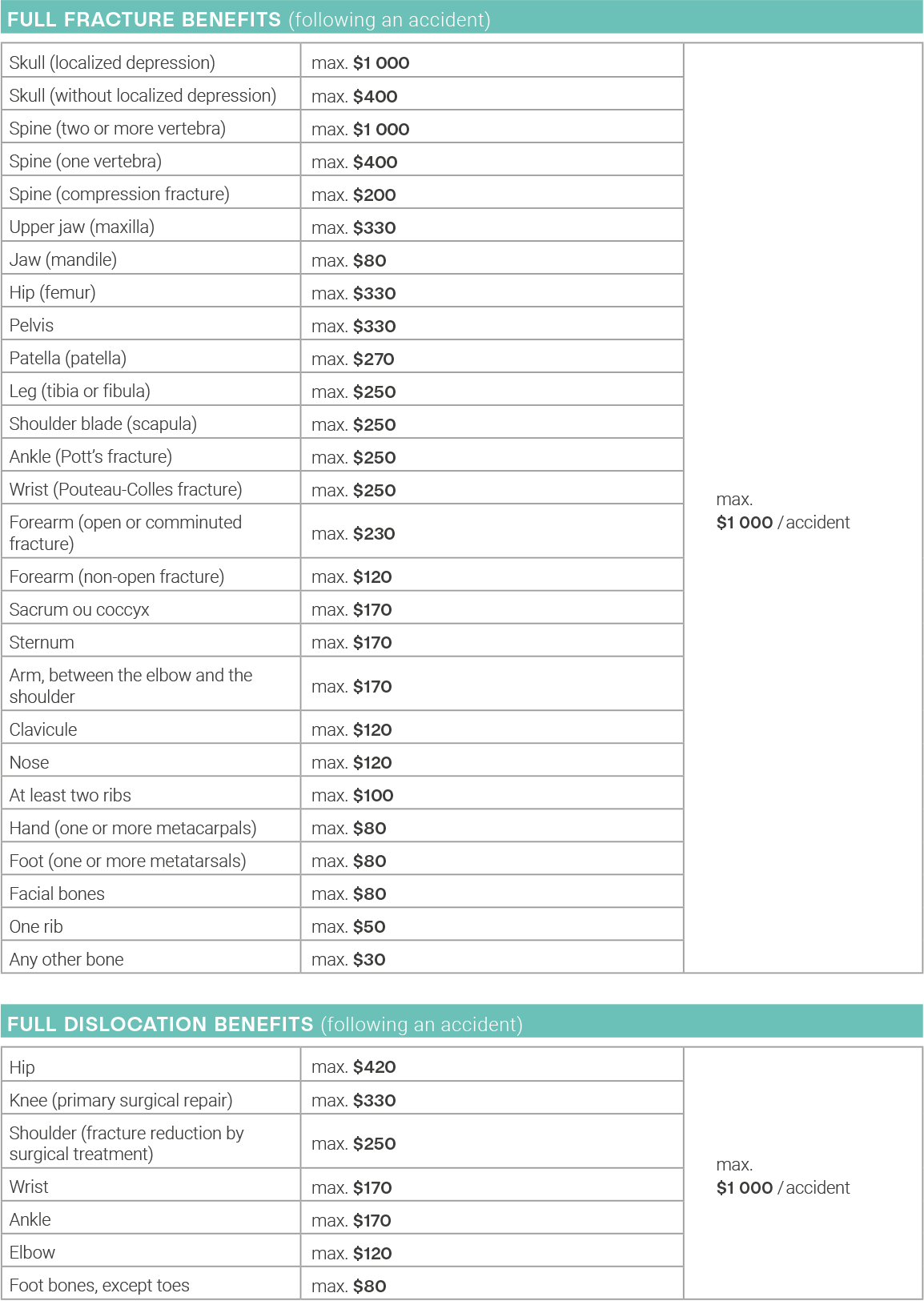

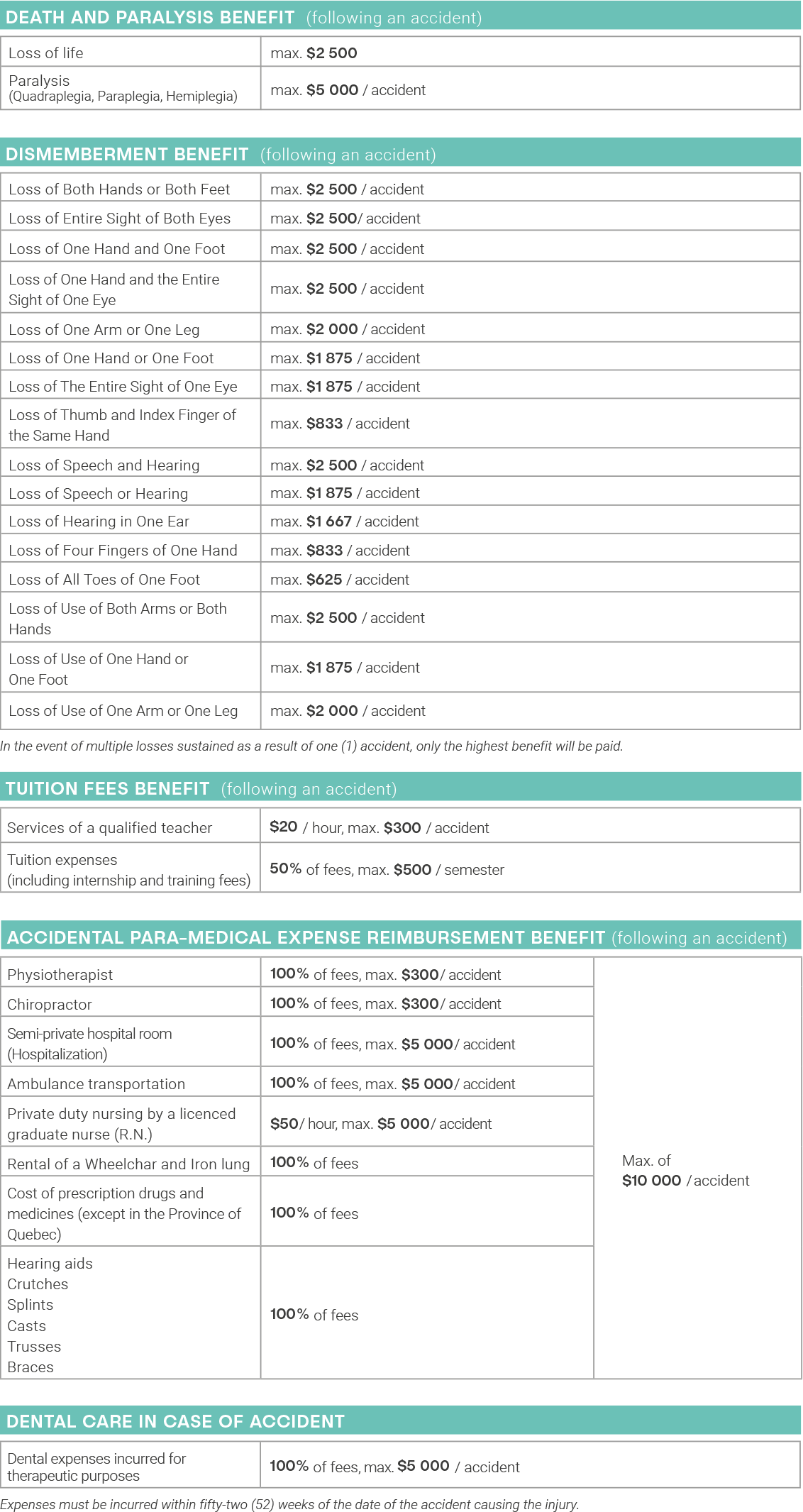

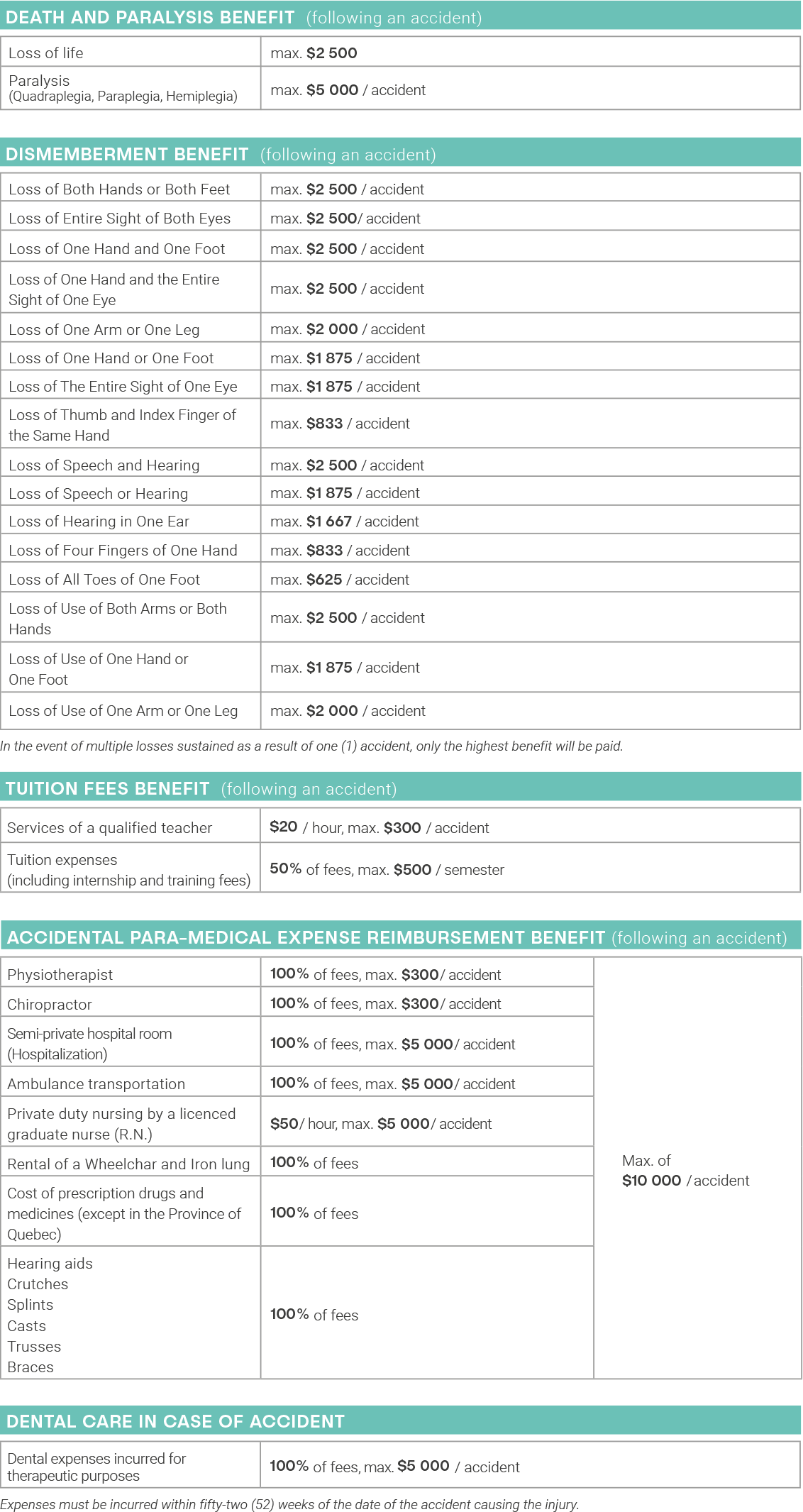

Accident Insurance

Maintaining your student plan coverage means you’ll benefit from affordable coverage in case of an accident.

Accident insurance under your plan provides benefits covering a wide range of situations, such as dental costs stemming from an accident, and health care costs.

Accident insurance also covers the costs of hospitalization, chiropractor and physiotherapist services, allowing you to devote your energy to recovering from the accident.

Your policy number for Accident claims is: SRG 914 0579-028

What constitutes an accident?

An accident is defined as an unintentional and unplanned event caused by an external source.

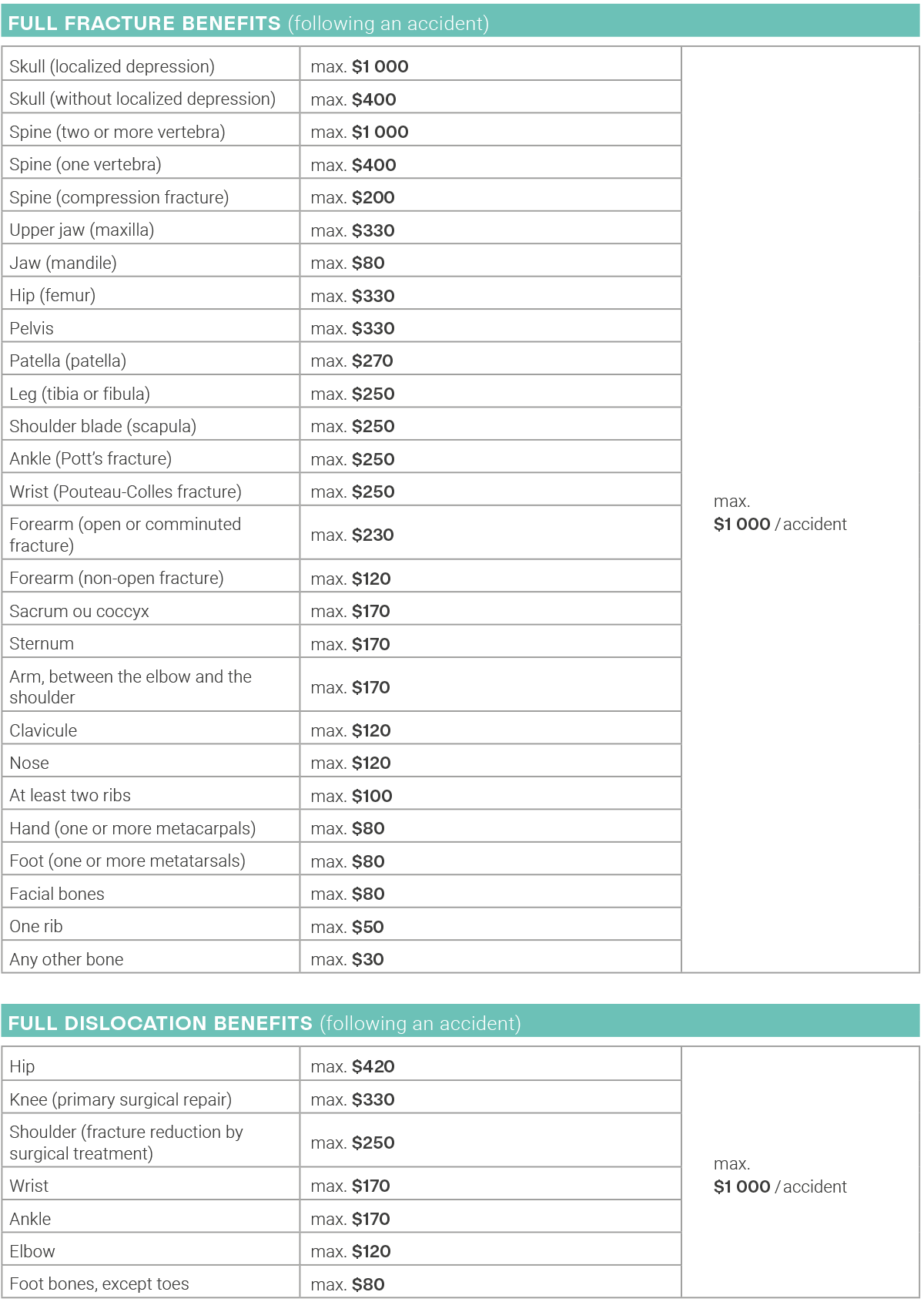

Compensation for fractures and dislocations following an accident

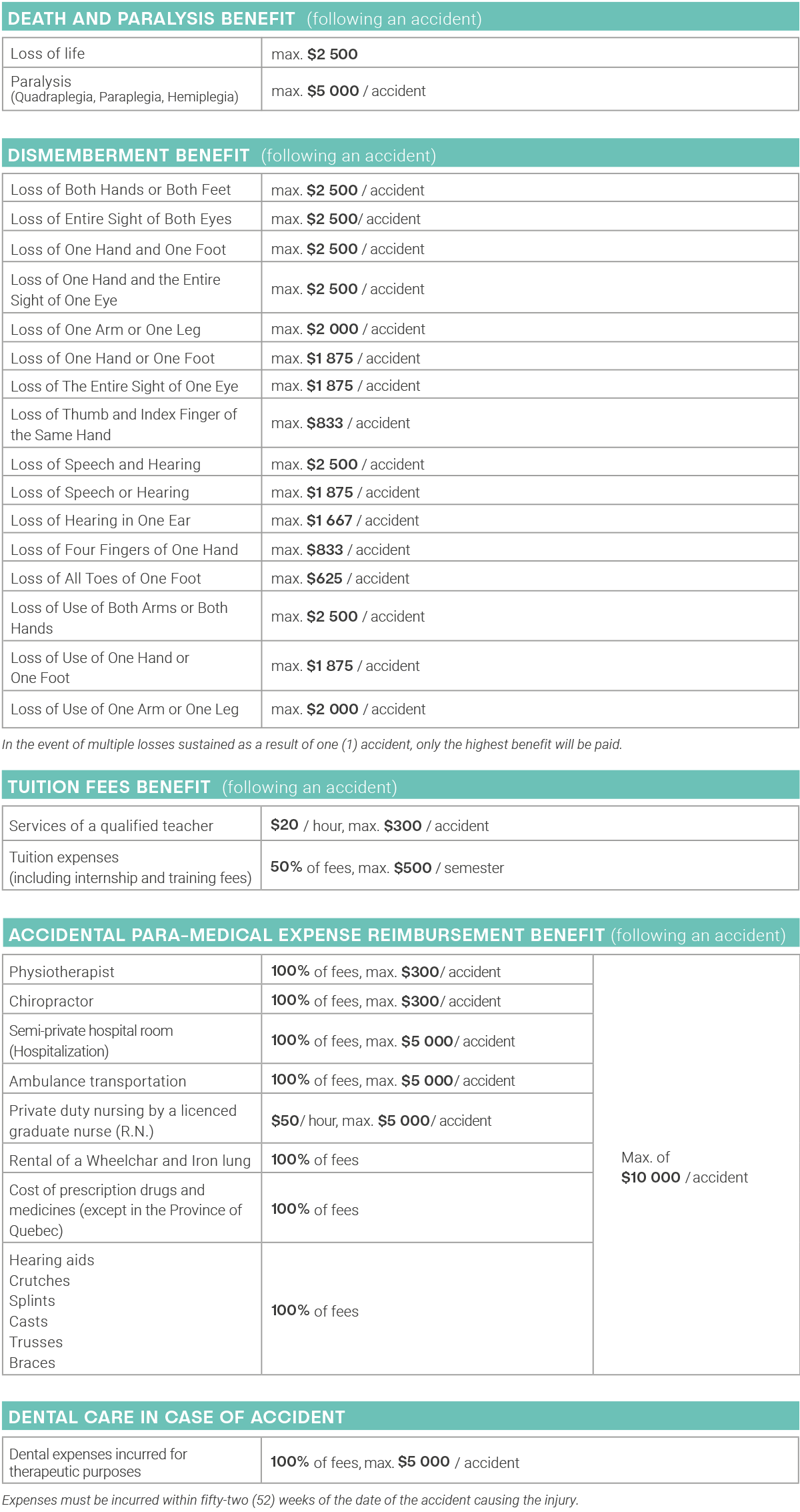

Compensation in Case of Accidental Death and Dismemberment (AD&D)

Please refer to the loss schedule included in the INFO-Accident for more information about reimbursement terms.

Accident Plan (coming soon)

Accident Insurance Claim

To submit a claim, please contact the AIG Insurance Company of Canada directly at 1-877-317-8060 or AHClaimscan@aig.com.

You can also contact our customer service department at 1-877-976-2567.

If your other insurance plan includes dental trauma coverage or other supplementary health care coverage, you must submit your claim to AIG subsequently. However, the Major Plan team remains available to help you with the coordination of the benefits process.

Your policy number for Accident claims is: SRG 914 0579-028

Please note: Deadlines apply for submitting a claim.

| Time Between the Accident and Resulting Injury or Loss | Maximum Time Before First Reimbursement | |

|---|---|---|

| Death and Dismemberment | No more than 365 days after the accident | |

| Assessment fees, Paramedical fees, and Accident-related Dental | No more than 30 days

after the accident |

Within 52 weeks of the accident that caused the injury |

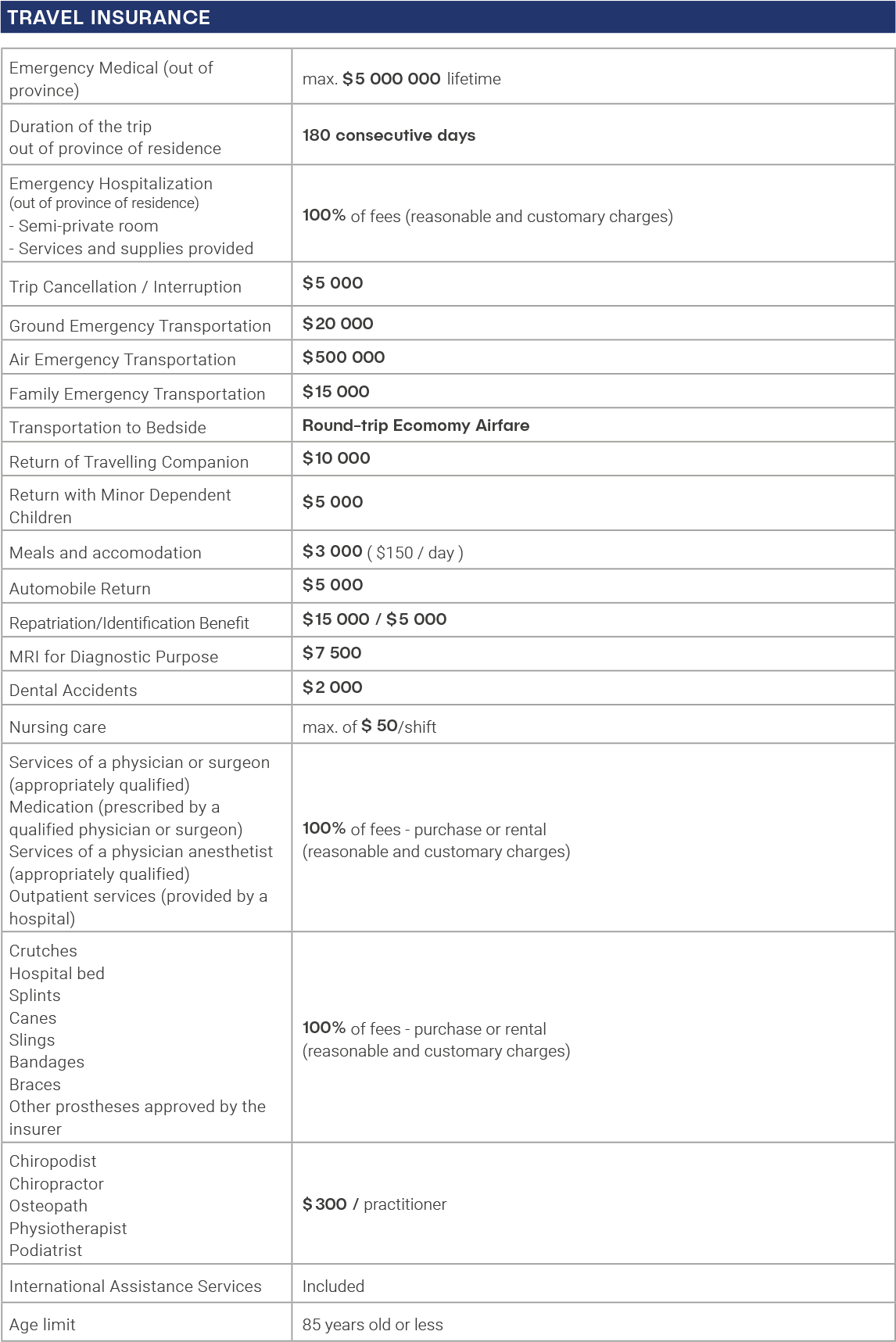

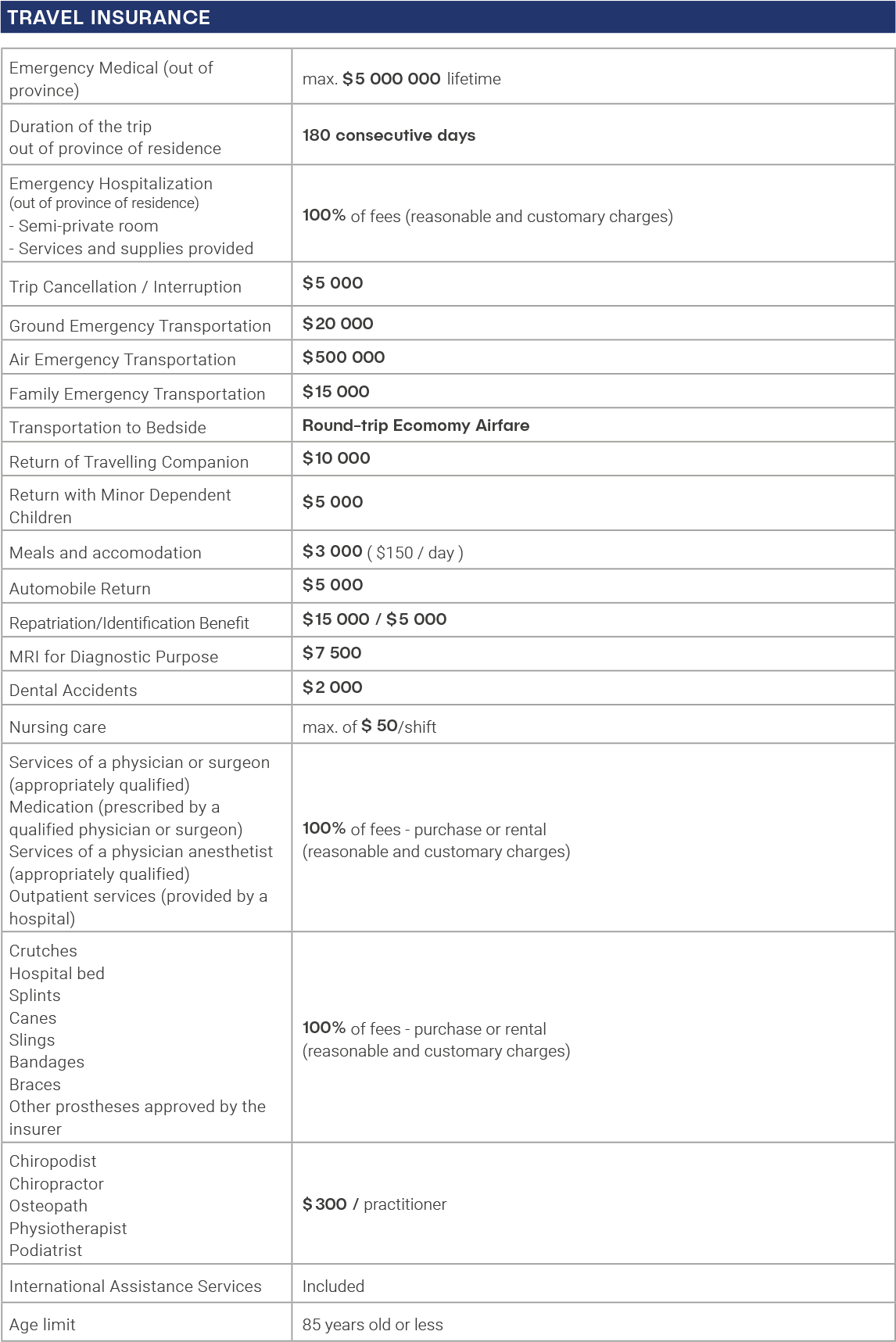

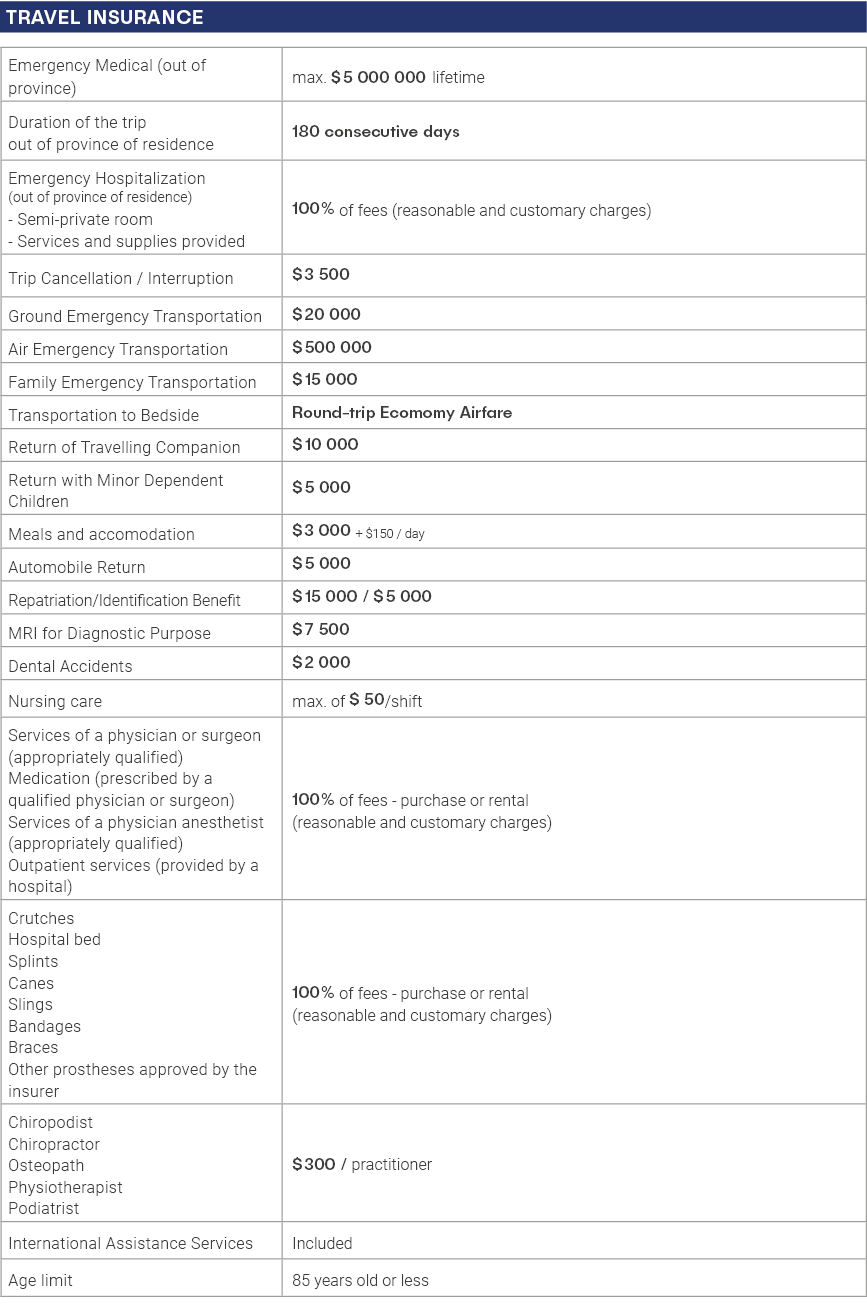

Travel Insurance

The Travel component of the Plan offers coverage for medical emergencies abroad and travel cancellations up to $5 million.

Your policy number for Travel claims is: 9426277-008

To submit a Travel insurance claim, contact AIG Insurance Company of Canada (AIG) directly at 1-877-207-5018. Coverage is valid for trips up to 180 consecutive days. In addition, travel must take place during the current coverage period.

Coverage is valid for trips up to 180 consecutive days. In addition, travel must take place during the current coverage period.

The Travel Passport is a reference to keep on hand when traveling. It provides easy access to important numbers in the event of an incident.

Travel Passport (coming soon)

Please note that students aged 86 and over are not covered by travel insurance. If you have any questions regarding travel coverage, please contact a Major Plan Client Services representative.

Coverage Offered by

Heath and Dental: Assumption Life

Accidents and Travel: AIG Insurance Company of Canada

2023-2024 Coverage

The coverage period was from September 1, 2023 to August 31, 2024.

Please note that drug coverage is not included in your plan and that it does not replace the drug coverage required by the Quebec government.

-

2023-2024 Health coverage

-

2023-2024 Dental coverage

Eligible costs are as determined by the Dental Association of the Canadian province where the insured individual resides (generalist rate). The information provided is for reference purposes only. Clauses in the coverage contract take precedence. Some restrictions may apply. A doctor’s note may be required and some services may only be performed by a recognized professional. Your claim must be received by Major Plan’s claims department no later than 365 days after the date you received the service.

-

2023-2024 Accident coverage

Compensation for fractures and dislocations following an accident

Compensation in Case of Accidental Death and Dismemberment (AD&D)

-

2023-2024 Travel coverage

Please note that travel insurance is not available to students aged 70 and over. If you have any questions about travel coverage, please contact a Plan Major customer service agent.

Claims 101

Important Numbers Health and Dental Claims Accident and Travel Claims Previous Year’s Claims Coordination of Benefits

Please note that claims processing is paused during the change/withdrawal period.

Please note that you will be able to create your profile on the mobile application and web portal only after the amendment and withdrawal period ends.

Important Numbers

Would you like to make a claim and don’t know which numbers to use? Here’s a list of important numbers to use. This is not a sample card, but your numbers. Your certificate number corresponds to your student ID Number, and your dental health group number is 57199.

Health and Dental Claims

There are several ways to submit a claim.

When making claims, it is important to provide your name, permanent code and your policy/group number. Additionally, by providing your direct deposit information, you will receive your payment much more quickly

Claims will be processed after the amendment and withdrawal period ends. Claims are processed within six (6) business days of document receipt.

When your tuition fees have been fully paid, you will be able to submit your claims retroactively. Your request for reimbursement must be received by Plan Major’s claims department no later than 365 days after the date you received the service. It is also not recommended to wait this long to submit your claims.

-

By Email

To submit a claim by email, scan or take a picture of your invoice (dental or paramedical) using your smartphone, and email it to claim@majorplan.ca.

Your name, your student ID Number, your policy number must be included at the top of the email, as well as a void cheque. -

Via Mobile Application or Web Portal

Claims can be submitted through our mobile app and web portal. Submission of claims and uploading of receipts can be done directly from your profile. In addition, we highly recommend that you provide your banking information under “Direct Deposit” if you wish to receive your reimbursement more quickly.

You will be prompted to create an ID using your certificate number (student ID Number) , policy/group number, date of birth, and postal code noted in your academic file. -

Directly from the Health Care Professional

Dental offices may submit a dental claim form directly if requested. The amount of the bill could be reduced immediately, depending on the terms of the coverage. The TELUS ADJUDICARE 34 / AUTOBEN alphanumeric identifier, policy/group number, and student ID Number must be provided to the professional when the form is being filled out.

-

By Fax or Mail

Submit your claims by providing copies of your health care receipts and/or claim form by fax, or mailing them to the following address:

Major Plan

CP 70025 SUCC QUÉBEC-CENTRE,

Québec, QC, G2J 0A1Fax: 1-819-205-0714

Please ensure that your name, your student ID Number provided by your educational institution, as well as your policy/group number are included in all your correspondence with us. Please note: in order to expedite the repayment of your claims, it is highly recommended that you send us a void cheque.

Watch the video to learn how to make a claim ↓

Accident and Travel Claims

To file a claim for accident and travel insurance, we invite you to contact AIG Insurance Company of Canada (AIG) directly. Please note that there are two separate telephone numbers to reach them, depending on whether you are making an accident or travel claim.

-

Accident

For accident claims, you must contact AIG at 1 877 317-8060. Please note that accident coverage always applies second when you already have health coverage. If in doubt, don’t hesitate to contact us. We’ll be happy to refer you and help you through the process. Please ensure that your name, your student ID Number, and your policy/group number are included in all your correspondence with AIG.

-

Travel

For travel claims, please contact AIG directly at 1 877 207-5018. Please ensure that your name, your student ID Number, and your policy/group number are included in all your correspondence with AIG.

Previous Year’s Claims

You may submit your claims within 365 days of the date the service was received. For example: If you consulted a health specialist on October 13, 2023, you have until October 13, 2024 to submit a claim for this service.

Refer to the coverage in effect at the time the service was obtained to determine the eligible claim amount.

Coordination of Benefits

Since you may be already covered by another insurance plan, your association offers you a supplemental insurance plan that allows the coordination of benefits for which you are eligible. Coordination of benefits allows you to combine the benefits and services from your student plan with those received from your parents’, your spouse’s, or your employer’s plan. It is important to confirm the existence of other coverages and to compare them. Claims for reimbursement can be made to multiple plans, however, the total sums received under all claims may not exceed 100% of the costs incurred. For this reason, it is important to determine the order in which claims should be submitted to your various group plans to coordinate benefits.

The order in which claims are submitted to multiple group plans is determined by your coverage type.

- Policyholder: your employers’ or student association’s plan.

- Dependent and Spouse: your parents’ or your spouse’s employers’ plan.

-

Coordination with Your Employer’s Plan

The procedure to coordinate your student association’s plan with your employer’s plan is as follows:

1. Submit your health or dental claim to your employer’s plan’s insurance company, making sure to keep a copy of the receipts if submitted by mail.

2. Once the claim is processed, you will receive a “Statement of Benefits” from your employer’s insurance company.

3. Submit your claim to Major Plan along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. Major Plan will send you the eligible amount, and the second “Statement of Benefits” will be available for download from the web portal. -

Coordination with Your Parents’ or Spouse’s Plan

The procedure to coordinate your student association’s plan with your parents’ or spouse’s plan is as follows:

1. Submit your health or dental claim to Major Plan, making sure to keep a copy of the receipts if submitted by mail.

2. Once the claim is processed, download the “Statement of Benefits” from the Major Plan web portal.

3. Submit your claim to your parents’ or spouse’s plan’s insurance company along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. Your parents’ or spouse’s insurance company will send you the eligible amount along with a second “Statement of Benefits.” -

Coordination with Two (2) Student Supplemental Plans

You may be studying in two (2) educational institutions and benefit from a supplemental insurance plan for both. If this is the case, the procedure to coordinate both of your student association’s plans may vary according to your student status (full-time or part-time). Full-time or part-time student status is established by your educational institution.

If you have FULL-TIME student status with one of your educational institutions, and PART-TIME status with the other:

1. Submit your health or dental claim to the plan insurance company for the educational institution in which you have FULL-TIME student status, making sure to keep a copy of the receipts if submitting by mail.

2. Once the claim is processed, you will receive a “Statement of Benefits” from this educational institution’s insurance company.

3. Submit your claim to the plan insurance company for the educational institution in which you have PART-TIME student status along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. The above educational institution’s insurance company will send you the eligible amount along with a second “Statement of Benefits.If you have the same student status in all your educational institutions FULL-TIME/FULL-TIME or PART-TIME/PART-TIME:

When your student status is the same in both of your educational institutions, the order of precedence for the 1st payer is determined according to the coverage start date of the oldest plan.

1. Submit your health or dental claim to the insurance company for the educational institution whose plan’s coverage start date is the oldest, making sure to keep a copy of the receipts if submitting by mail.

2. Once the claim is processed, you will receive a “Statement of Benefits” from the educational institution’s plan insurance company.

3. Submit your claim to your second plan’s insurance company along with a copy of your health care or dental receipts, the appropriate form, and the “Statement of Benefits.”

4. The above insurance company will send you the eligible amount along with a second “Statement of Benefits.”If the precedence of the first payer cannot be established, your claim will be subject to a proration of the benefits, meaning that the benefits paid by the insurance plans are calculated according to the amount that would be paid by each plan if it was 1st payer. For more information, contact customer service.

EXAMPLE: Eligible dental costs $70

Plan A (Co-insurance 70%): Liability as 1st payer $49

Plan B (Co-insurance 60%): Liability as 1st payer $42

By adding the sums that would be paid by both plans as 1st payer, we get: $48 + $42 = $91 But the total sums received under both plans may not exceed the eligible costs of $70.

Plan A (proration: $49 divided by $91 = 53.85%): Benefit paid $37.70

Plan B (proration $42 divided by $91 = 46.15%): Benefit paid $32.30

-

Take Careful Note

Since you may be covered by more than one insurance plan, it is important that you inform your other insurance carrier. The total sums received under all your plans for a given item, service received, or care claimed may not exceed 100% of the eligible costs. In some cases, the total sums received under all your plans may be lower than the costs incurred for a given item, service received, or care claimed.

Failure to provide all the information required for the proper assessment of your file, whether intentional or not, may result in the termination of your coverage plan.

Student Assistance Program

Offered Services Emergency Help LineTelus Health Virtual Care Web Portal and Mobile ApplicationHow to Activate your Account?

The primary function of the Assistance Program is to provide psychological support to all members of the student body.

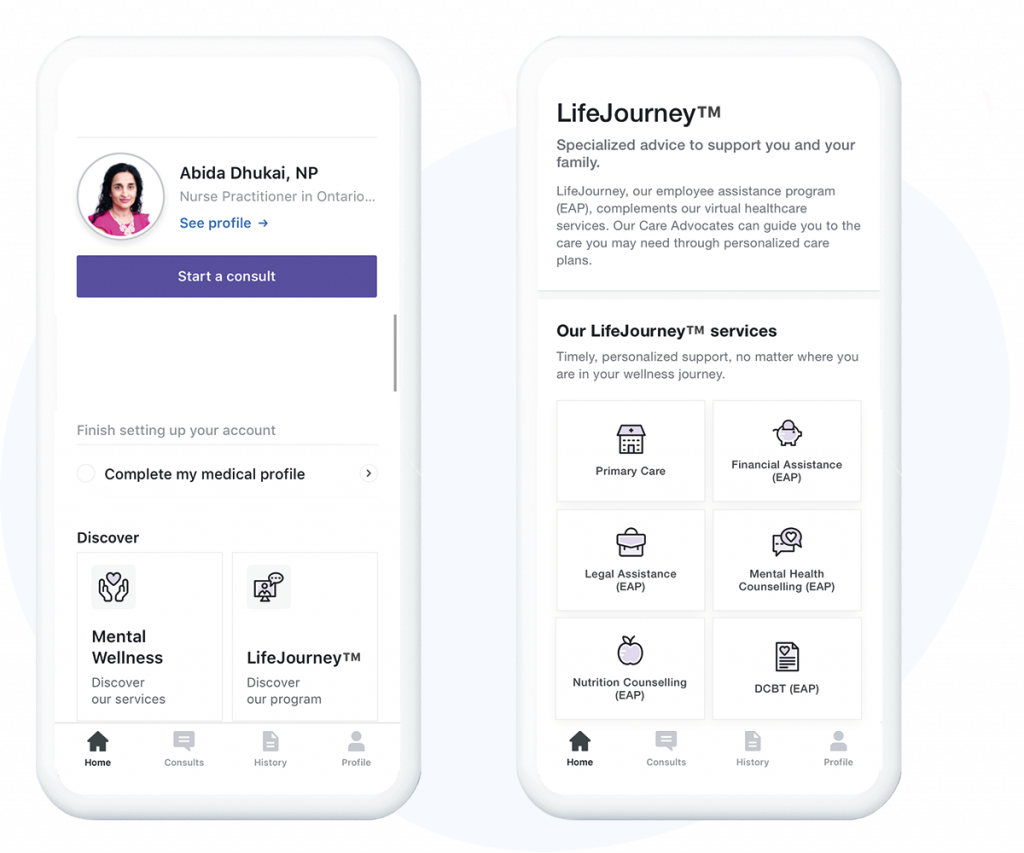

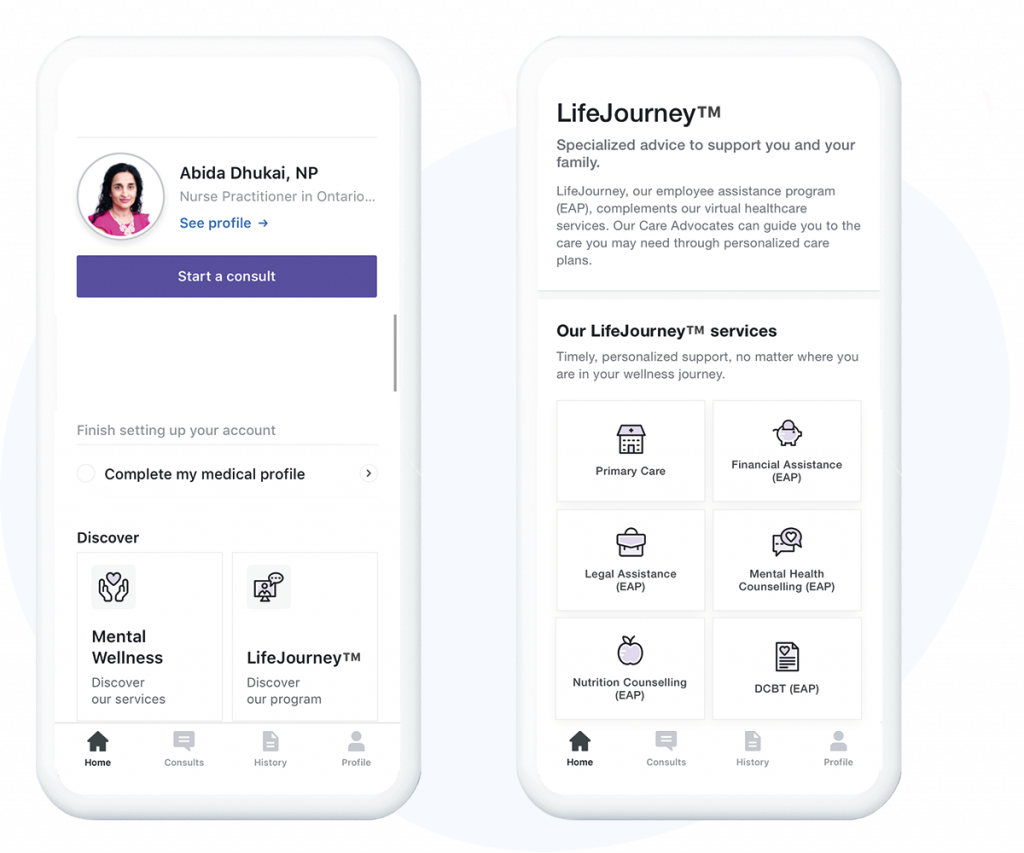

The assistance program offers access to a 24/7 support center. The LifeJourney™ service by Telus Health offers several consultation services and professional interventions focused on short-term problem-solving. Please do not hesitate to contact our team at 1 877-976-2567 if you have any questions regarding this service.

Telus Health LifeJourney™

Emergency Help Line

Contact the helpline at 1-855-636-6846 for immediate assistance in an emergency. The Care Ambassador or clinician will assist you and direct you to the appropriate care.

Telus Health Virtual Care Web Portal and Mobile Application

Register for the Telus Health Virtual Care web portal and mobile app to access a variety of support tools, a resource center, online consultations, and more. When you first log in, use your group number 57199 as well as your personal login that corresponds to your Student ID number.

Download the mobile application! Google playApple Store

How to Activate your Account?

Step 1

Enter the email address you wish to use to set up your account.

Step 2

Enter your province.

Step 3

Select “I am eligible as a student”.

Step 4

Select “I will use my group number”.

Step 5

Enter your group number: 57199

Enter your coverage identifier: Student ID number

Step 6

Click on “Email me my activation link”. Then click on the link sent to your email address and complete your registration.

Forms and other documentation

Below, you will find useful information such as coverage contracts, limitations, and the information management policy.

-

Brochures from Previous Years

-

Forms

-

Coverage Contracts

-

Limitations and exclusions

-

Information Documents

-

Student Assistance Program

-

Coverage Offered by

Heath and Dental: Assumption Life

Accidents and Travel: AIG Insurance Company of Canada

Withdrawal

Types of Withdrawal Withdrawal Period Request for Withdrawal

Enrolment in the student supplemental group insurance plan is automatic, however, you may opt-out, free of charge, during the plan’s amendment and withdrawal period.

Types of Withdrawal

The annual withdrawal allows you to be temporarily withdrawn from the plan during the current academic year. However, you will be reinstated automatically at the beginning of the next academic year. As a result, you will have to withdraw again, if you wish to do so, during the plan’s amendment and withdrawal period. It is not possible to withdraw only from some components of the plan.

Members who registered for the Fall semester and have kept their plan may not withdraw during the Winter semester withdrawal period.

Amendment and Withdrawal Period

Fall Semester – August 25th to September 24th

Winter Semester – January 27th to February 26th

The amount of your premium will be refunded to you by Major Plan after the end of the withdrawal period.

Request for Withdrawal

The withdrawal request must be made within the prescribed time frame. You will have no other opportunity to exercise your opt-out option. To withdraw from the supplementary insurance plan, please complete and forward the Web-based form below. An email confirmation will be sent once the application has been successfully saved. Keep this email as proof of withdrawal.